High-Performance Factor Evaluation with DolphinDB

In investment research, factors are central to explaining returns and asset pricing, and continuously validating and selecting effective factors is essential for achieving excess returns. Factor evaluation provides a standardized framework to assess both the statistical significance and the informational value of factors. This tutorial presents a high-performance factor evaluation framework built on DolphinDB, supporting analytical evaluation of both single-factor and two-factor models.

1. Introduction to Factor Evaluation Framework

Compared with Python-based solutions, DolphinDB delivers significantly higher data I/O efficiency in factor evaluation scenarios, providing a more efficient computational foundation for quantitative analysis. DolphinDB currently supports part of the functionality of the Alphalens module; however, the Alphalens project has long been discontinued and is costly to adopt in practice. Therefore, we aim to build a factor evaluation framework with improved readability and a more comprehensive set of evaluation metrics.

Relative to the existing Alphalens implementation in DolphinDB, the

factorBacktest module leverages metaprogramming (with macro

variables, requiring DolphinDB version 2.00.12 or later), which substantially

enhances code readability and structural clarity. The module evaluates factors using

the following core metrics:

| Category | Metric |

|---|---|

| drawdown | maximum drawdown |

| maximum excess return drawdown | |

| returns | annualized returns |

| annualized excess returns | |

| significance test of returns | |

| volatility | annualized volatility |

| annualized excess volatility | |

| Sharpe ratio | Sharpe ratio |

| information ratio | information ratio |

| relative win ratio | strategy outperformance ratio vs benchmark |

| information coefficient | mean information coefficient (IC) |

| standard deviation of IC | |

| proportion of IC > 0 | |

| proportion of IC > 0.03 | |

| mean rank IC | |

| rank ICIR |

The two modules differ in the following functionalities:

| Functionality | factorBacktest |

Alphalens |

|---|---|---|

| forward returns calculation for multiple holding periods | × | √ |

| factor return calculation | × | √ |

| factor turnover analysis | × | √ |

| strategy outperformance ratio vs benchmark | √ | × |

| Newey-West adjustment to correct for residual heteroskedasticity and autocorrelation | √ | × |

| Fama-Macbeth regression to adjust standard errors for cross-sectional residual correlation | √ | × |

| risk-adjusted factor returns | √ | × |

| dependent double sorts | √ | × |

After downloading the factorBacktest.dos file at the end of this document and

placing the module in the getHomeDir()+/modules directory, the

factorBacktest module can be accessed in DolphinDB. Using the

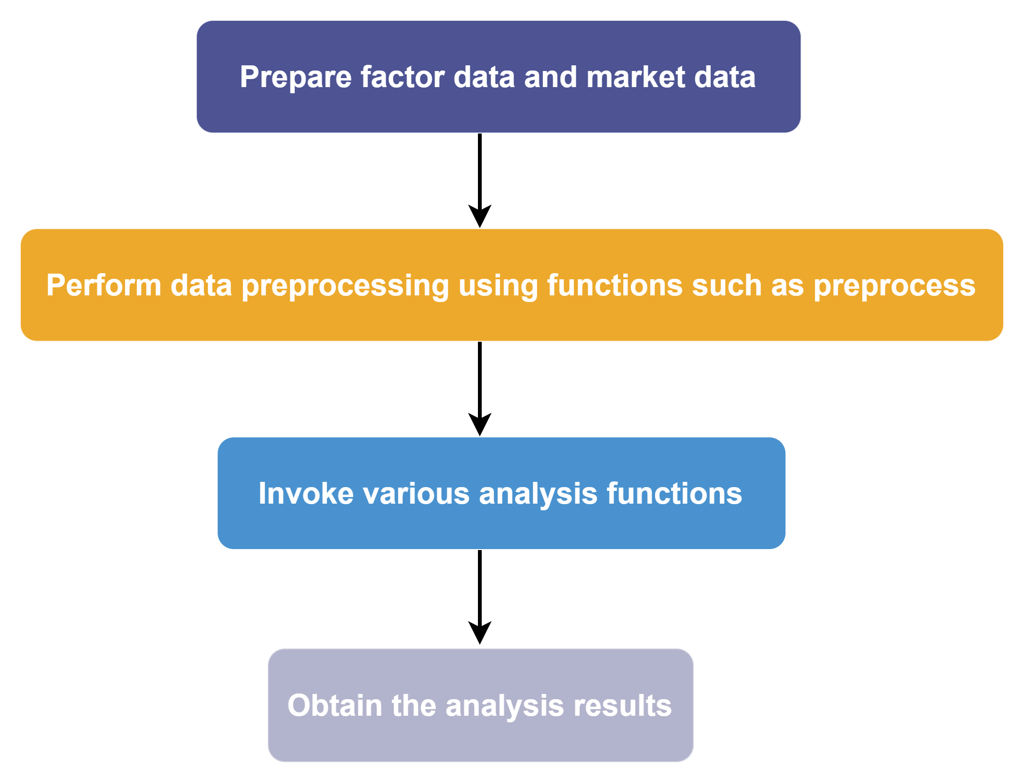

module typically involves four steps:

- Step 1: Prepare factor data and market data.

- Step 2: Perform data preprocessing using functions such as

preprocess. - Step 3: Invoke analysis functions.

- Step 4: Call the relevant functions to obtain the analysis results.

In the following sections, we will introduce how to use the

factorBacktest module step by step.

2. Data Preparation

2.1 Data Import

This factor evaluation framework uses the CSV files provided in the

factor_backtest_data directory. You can download the

factor_backtest_data archive from the end of this document and

extract it to <YOUR_DOLPHINDB_PATH>/server/. The data can then be

loaded directly with the loadText function for subsequent

computation and analysis.

factorTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/factorTB.csv")

mktmvTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/mktmvTB.csv")

industryTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/industryTB.csv")

bp_factorTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/bp_factorTB.csv")

bpTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/bpTB.csv")

retTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/retTB.csv")

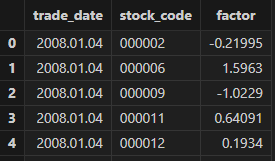

benchmarkTB = loadText("<YOUR_DOLPHINDB_PATH>/server/factor_backtest_data/benchmarkTB.csv")Use select top 100 * from factorTB to preview the factor in the

factorTB table, where trade_date is the trading date, stock_code is the stock

identifier, and factor is the factor name.

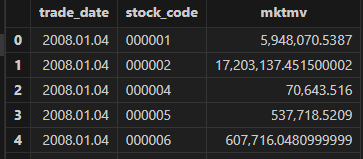

Use select top 100 * from mktmvTB to preview the market

capitalization in mktmvTB, where mktmv represents market capitalization of each

stock.

Use select top 100 * from industryTB to preview the industry

classification in industryTB, where industry indicates the industry of each

stock.

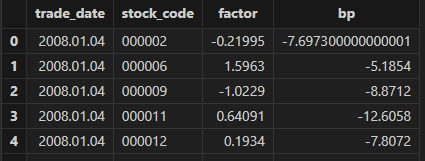

Use select top 100 * from bp_factorTB to preview the

multi-factor data in bp_factorTB, where both factor and bp are factor

variables.

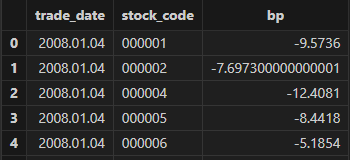

Use select top 100 * from bpTB to preview the bp factor in

bpTB.

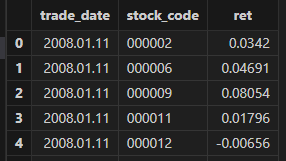

Use select top 100 * from retTB to preview the stock return in

retTB, where ret denotes returns.

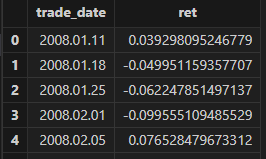

Use select top 100 * from benchmarkTB to preview the benchmark

return.

This module does not impose strict requirements on column names. You only need to ensure that the input tables follow the same schema as the examples above. For convenience, it is recommended to use consistent column names for trading dates and security identifiers across all input tables.

In terms of data frequency, the module supports input data at daily, weekly, or monthly frequencies.

2.2 Data Preprocessing

factor and bp can be processed directly using the

preprocess function, which performs outlier treatment,

standardization, and neutralization.

Code examples and a preview of the processed results are as follows:

use factorBacktest

//data preprocessing

factorNew = preprocess(factor=factorTB,

factorName="factor",

mktmvTB = mktmvTB,

industryTB = industryTB,

dateName = "trade_date",

securityName = "stock_code",

mvName = "mktmv",

indName = "industry",

delOutlierIf = true,

standardizeIf = true,

neutralizeIf = true,

delOutlierMethod = "mad",

standardizeMethod = "rank",

n = 3,

modify = false ,

startDate = 2008.01.04,

endDate = 2017.01.20)

// Observe the result after factor preprocessing

select top 100 * from factorNew

/*

trade_date stock_code factor

2008.01.04 000002 -0.06393232889798993

2008.01.04 000006 1.5546531851632837

2008.01.04 000009-1.2096673940460276

2008.01.04 000011 0.7557481911404614

2008.01.04 000012 0.32144219178486666

*/The preprocess function exposes several key parameters:

- factorName: the name of the column that contains factor values in the input factor table. In the example, the factor values in factorTB are stored in the factor column.

- mvName and indName: the column names representing market capitalization and industry classification in the mktmvTB and industryTB tables, respectively.

- dateName and securityName: the column names for the trading date and the security identifier.

3. Single-Factor Analysis

The factorBacktest module provides a systematic and comprehensive

framework for single-factor analysis, enabling factor performance to be evaluated

from multiple perspectives. Key metrics include IC, ICIR, Rank IC, information

ratio, Sharpe ratio, and maximum drawdown, allowing for a thorough and well-rounded

assessment of factor effectiveness.

In this section, we use the factor extracted in the previous chapter as an example to

demonstrate how to perform single-factor analysis with the

factorBacktestmodule.

singleResult = singleFactorAnalysis(factorTB = factorNew, //Factor data

retTB = retTB, //Return table

factorName = "factor" , //Factor name

nGroups = 5, //Number of factor groups

rf =0.0, //Risk-free rate of return, default is 0

mktmvDF = mktmvTB, //Market capitalization table

dateName="trade_date", //Trading date column name

securityName = "stock_code", //Security code column name

retName = "ret", //Return column name

mvName = "mktmv", //Market capitalization column name

startDate = 2008.01.04, //start date

endDate = 2017.01.20, //End date

maxLags=NULL, //Lag order, default is NULL

benchmark = benchmarkTB, //Market benchmark return table, default is NULL

period = "DAILY" ) //Frequency, valid values include "DAILY", "WEEKLY", "MONTHLY"Single-factor analysis is conducted via the singleFactorAnalysis

function. The result singleResultis a dictionary with nine keys:

- groupRet: grouped portfolio return.

- retStat: statistical significance results for returns across groups.

- ICTest: calculations of IC, IR, and related metrics.

- backtest: grouped backtesting results for the factor.

- timeIndex: X-axis used for plotting.

- netValue: net asset value series of the grouped portfolios.

- retTable: long-short return series of the factor.

- title1 and title2: titles for the grouped net value curve and the long-short return curve, respectively.

3.1 Grouped Returns

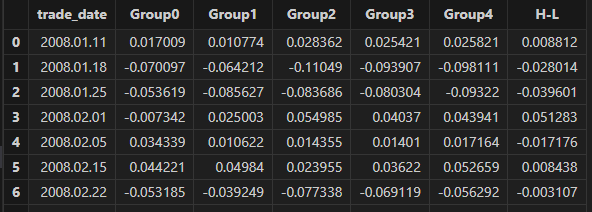

After preprocessing the factor data, stocks are sorted by factor values and divided into groups, and the return of each group is calculated. The "H-L" group represents the long-short portfolio return, calculated by going long on the highest factor group and short on the lowest factor group.

The grouped returns can be observed and formatted to six decimal places. An example of the corresponding code and results is shown below.

groupRet = singleResult["groupRet"]

groupname = ["Group0" , "Group1" , "Group2" , "Group3" , "Group4" , "H-L"]

<select top 10 trade_date , round(_$$groupname , 6) as _$$groupname from groupRet>.eval()

3.2 Statistical Significance of Grouped Returns

Once the grouped returns are calculated, their statistical significance can be tested. In multi-factor regression models, residuals often exhibit heteroskedasticity and autocorrelation. Using standard OLS to estimate the standard errors of β may lead to inaccurate results of significance testing. This module implements a Newey–West adjustment (Newey & West, 1987) to correct for heteroskedasticity and autocorrelation in the residuals.

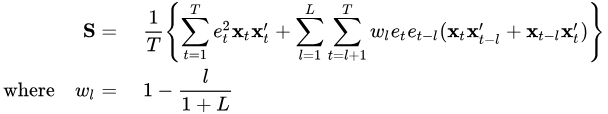

The core Newey–West adjustment provides a consistent covariance estimator that corrects for heteroskedasticity and autocorrelation. Specifically:

- T denotes the total number of time periods,

- et is the residual at time t,

- Xi=[xi1,xi2,...,xiK]′ is the i-th row of X transposed,

- L is the maximum lag used to account for autocorrelation.

The resulting S is then substituted into the OLS variance expression VOLS to obtain the Newey–West heteroskedasticity- and autocorrelation-consistent covariance estimate.

In this section, the neweyWestTest function is used to estimate

the mean of grouped returns and output the t- and p-values adjusted via

Newey–West. The underlying computation is performed by the

neweyWestCorrection function.

The long-short portfolio statistics can be accessed via

singleResult["retStat"]["H-L"]. The output includes the

mean return (ret_mean(%)), p-value (p_value), and t-value (t_value).

// output:

// ret_mean(%): 0.465416325805543

// p_value: 0.00000568582996640643

// t-value: 4.591311581999794Analyzing the above results, it can be seen that the mean long-short group return rate of the factor is 0.465%, the p-value is 0.0000056, and the t-value is 4.59, indicating that the mean long-short return rate is significantly different from 0.

3.3 IC Test

The information coefficient (IC) measures the cross-sectional correlation between factor values and next-period stock returns, and is commonly used to evaluate a factor’s predictive power. A larger absolute IC indicates a more effective factor. A positive IC implies that higher factor values are associated with higher future returns, while a negative IC suggests the opposite.

The information ratio (IR) is defined as the ratio of the mean excess return to its standard deviation, and reflects the stability of a factor’s ability to generate alpha.

By evaluating both IC and IR together, we can assess both the predictive strength and robustness of a factor, and determine whether it is reliable for sustained investment.

singleResult["icTest"]

/*

output:

Rank_ICIR: 0.10311019138174475

Rank_IC mean: 0.05030535697624222

IC mean: 0.03846492107792371

Factor name: 'factor'

IC standard deviation: 0.09652585561925417

IR: 0.39849344852894575

Proportion of IC>0 (%): 64.57883369330453

Proportion of IC>0.03 (%): 52.48380129589633

*/The output obtained from singleResult["icTest"] is a dictionary

with eight keys. From the results, the IC mean is 0.038, which does not meet the

commonly accepted threshold for strong predictive power (≥ 0.05). The IR is

0.398, falling below the stability benchmark (≥ 0.5). Overall, the factor

exhibits only weak predictive ability and relatively poor stability.

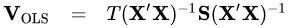

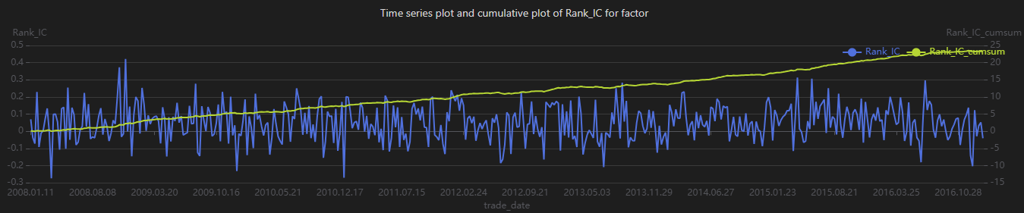

In addition, the getFactorIc function can be used to plot both

time-series and cumulative charts of IC and Rank_IC. The corresponding code and

results are shown below.

correlation = getFactorIc(factorNew, retTB, "factor" ,"trade_date" ,"stock_code", "ret" , 2008.01.02 , 2017.01.31)

correlation['IC_cumsum'] = correlation["IC"].cumsum()

correlation['Rank_IC_cumsum'] = correlation["Rank_IC"].cumsum()Observe the factor IC and Rank_IC results, and set the output format to six decimal places:

//Observe factor IC and Rank_IC results

groupname = ["IC" , "Rank_IC" , "IC_cumsum" , "Rank_IC_cumsum"]

<select top 10 trade_date , round(_$$groupname , 6) as _$$groupname from correlation>.eval()

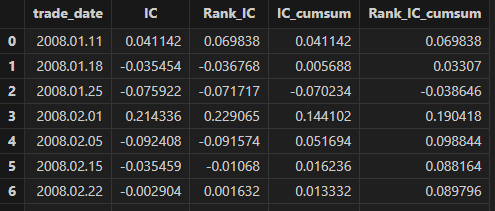

Plot using the plot function:

plot(table(correlation["IC"] ,correlation['IC_cumsum']) , correlation["trade_date"] , title = "FTime series plot and cumulative of IC for factor", extras={multiYAxes: true})

plot(table(correlation["Rank_IC"] ,correlation['Rank_IC_cumsum']) ,

correlation["trade_date"] , title = "Factor factor Long-Short Return Curves (Market

Cap Weighted)", extras={multiYAxes: true})

When analyzing IC time-series and cumulative charts, different types of information can be extracted. For example, frequent sign changes in IC, as shown in Figure 3-3, indicate unstable predictive performance across market regimes. The cumulative IC chart aggregates IC values over time and reflects the factor’s long-term predictive contribution. The steadily increasing cumulative IC in Figure 3-3 suggests that the factor consistently contributes positive expected returns over the long run.

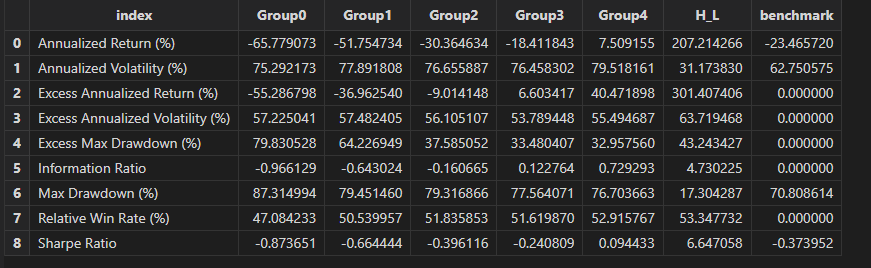

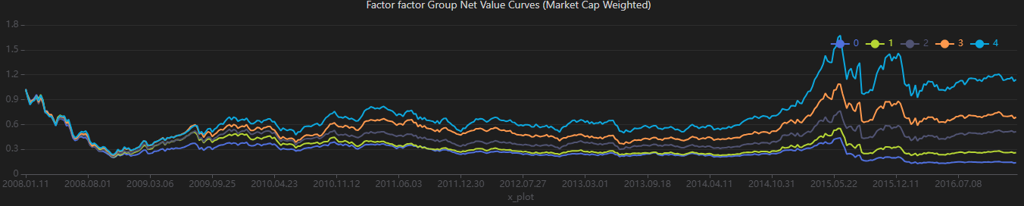

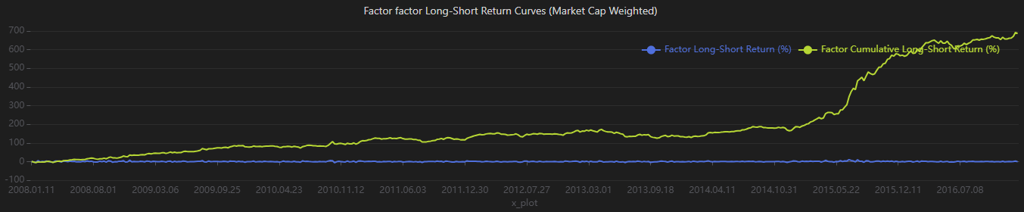

3.4 Factor Analysis and Net Value Curves by Group

In this section, we analyze the backtest results for each factor-based portfolio

group and plot both the net value curves for the groups and the long-short

return curve. The results of the single-group factor analysis can be obtained

from singleResult["backtest"], as shown below.

backtestTB = singleResult["backtest"]

//Observe group backtest results

groupname = ["Group0","Group1","Group2","Group3","Group4","H_L","benchmark"]

<select index , round(_$$groupname , 6) as _$$groupname from backtestTB>.eval()

plot(singleResult["netValue"], singleResult["timeIndex"], singleResult["title1"])

plot(singleResult["retTable"], singleResult["timeIndex"], singleResult["title2"])

From the results, the factor demonstrates strong return differentiation across groups in the backtest. However, the relatively high volatility indicates weaker risk control. In comparison, the long-short strategy performs better, exhibiting lower volatility and higher returns.

4. Two-Factor Analysis

The factorBacktest module also supports two-factor analysis. In this

section, we use the factor and bp factors as examples to demonstrate

how to perform two-factor analysis with the factorBacktest

module.

doubleResult = doubleFactorAnalysis(factorTB1 = bpNew , //Factor table 1

factorTB2 = factorNew, //Factor table 2

retTB = retTB , //return table

"bp" , //factor name 1

"factor" , //factor name 2

nGroups1 = 5, //Number of groups, default is 5

nGroups2 = 5,

mktmvTb = mktmvTB , //market capitalization table

dateName ="trade_date" , //transaction date column name

securityName = "stock_code", //Security code column name

retName = "ret" , //Return column name

mvName ="mktmv" , //Market capitalization column name

startDate = 2008.01.04, //start date

endDate = 2017.01.20, //Deadline

maxLags = NULL, //Lag order, default is NULL

rf=0.0 , //Risk-free interest rate, default set to 0

benchmark =NULL, //Market benchmark return table, default is NULL

period = "WEEKLY", //Frequency, optional parameters include "DAILY", "WEEKLY", "MONTHLY"

regressionStep = false) //Boolean value, indicating whether to perform the first step of Fama-Macbeth regression calculationThe doubleFactorAnalysis function is used to obtain the analysis

results, where factorNew and bpNew are the results of factor and bp

factors after data preprocessing. The output doubleResult is a dictionary with 4

keys:

- dbSortRet: returns sorted jointly by the bp and the factor.

- dbSortMean: mean group returns along with Newey–West–adjusted t-statistics.

- dbSortBacktest: backtest results by factor group.

- famaMacbethResult: results from the Fama–MacBeth regression.

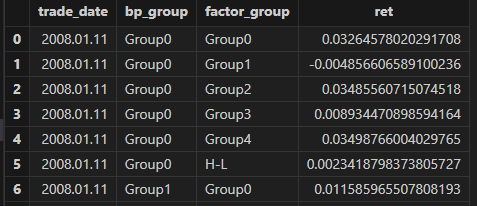

4.1 Returns from Dependent Double Sorts

In factor evaluation, dependent double sorts are commonly used to assess whether combining two factors leads to better performance than using either factor alone. This approach helps examine the degree of information overlap between the two factors and identify potential information again. Specifically, for two factors X and Y, assets are sequentially sorted and grouped by both factors to construct portfolios, whose performance is then analyzed.

4.2 Mean Returns from Dependent Double Sorts

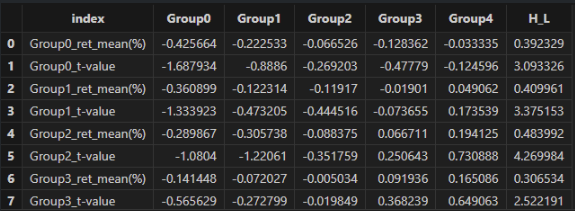

After computing portfolio returns based on the dependent double sorts of the factor and bp factors, we further estimate the mean returns for each group and report the corresponding Newey–West–adjusted t-statistics. The relevant code and output are shown below.

dbSortMean = doubleResult["dbSortMean"]

groupname = ["Group0" , "Group1" , "Group2" , "Group3" , "Group4" , "H_L" ]

<select index , round(_$$groupname , 6) as _$$groupname from dbSortMean>.eval()

In the results table, the index column represents the bp-based groups. The Group0~Group4 columns denote the factor-based groups. The results show that:

- Across all bp groups, the H-L long-short returns are positive, with relatively high t-values, indicating that the high-factor portfolios significantly outperform the low-factor portfolios. This suggests that the factor consistently distinguishes asset returns across different bp groups.

- For each bp group, the mean returns generally exhibit an upward trend from Group0 to Group4. This suggests that higher bp groups are associated with improved portfolio performance across different factor groups, indicating a positive impact of the bp factor on returns.

- The factor shows stronger monotonicity and statistical significance among assets with medium to high bp values (e.g., Group3 and Group4), suggesting that the effectiveness of the factor is related to asset size characteristics.

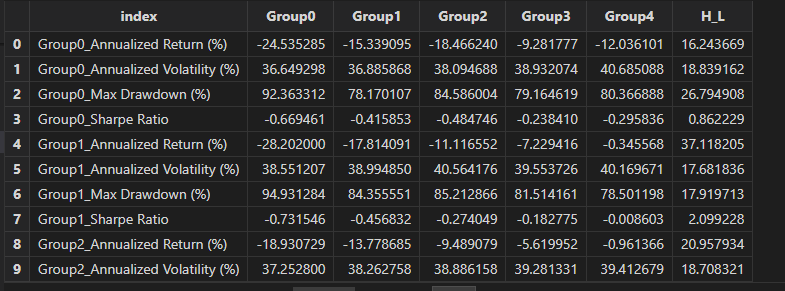

4.3 Backtest Metrics for Dependent Double-Sorted Portfolios

The factorBacktest module also supports the computation of

backtest metrics for double-sorted portfolios. These results can be obtained

using doubleResult["dbSortBacktest"].

dbSortBacktest = doubleResult["dbSortBacktest"]

groupname = ["Group0" , "Group1" , "Group2" , "Group3" , "Group4" , "H_L" ]

<select index , round(_$$groupname , 6) as _$$groupname from dbSortBacktest>.eval()

From the backtest metrics, we find that both the bp and factor values are positively associated with portfolio performance. As the bp and factor groups increase from Group0 to Group4, the Sharpe ratio and annualized returns rise steadily, while annualized volatility and maximum drawdown decline.

4.4 Fama–MacBeth regression

To mitigate the impact of cross-sectional correlation in regression residuals on

standard error estimation, the module also implements the Fama–MacBeth

regression based on Fama and MacBeth (1973), Risk, Return, and

Equilibrium: Empirical Tests. The functionality is provided

through the famaMacbethReg function.

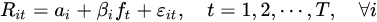

Similar to conventional cross-sectional regression, the Fama–MacBeth approach consists of two stages.

In the first stage, a time-series regression is performed for each asset to estimate its factor exposure βi by regressing individual asset returns on the factor returns.

In the second stage, a cross-sectional regression is conducted at each time point t, where asset returns are regressed on their estimated factor exposures βi.

This step is repeated independently for every time point. For example, with T=500 time points, 500 cross-sectional regressions are performed, each using only the cross-sectional data at that time. The final regression coefficients are obtained by averaging the coefficients across all time points.

Since the coefficients from the second-stage regressions may exhibit heteroskedasticity and autocorrelation, Newey–West adjustments are applied to obtain consistent standard error estimates.

The Fama–MacBeth regression results can be accessed

viadoubleResult["famaMacbethResult"].

doubleResult["famaMacbethResult"]

/*

output:

Average_Obs: 1,591.1749460043197

R-Square: 0.017901474327154446

factor:

t-statistic: 6.986433993363168

beta: 0.0019545565844644496

p-value: 0.00000000000988853444

standard error: 0.0002797645531785171

bp:

t-statistic: 3.6404282777536614

beta: 0.001105722959290441

p-value: 0.00030294518028139983

standard error: 0.0003037343067702823

*/

Note that the regressionStep parameter in famaMacbethReg

is a boolean vector indicating whether the two-step Fama–MacBeth procedure is

applied. By default, it is set to false, meaning that factor values are treated

as factor exposures (or factor exposures are directly provided), and only the

second-stage cross-sectional regression is performed.

The output is returned as a dictionary containing the model’s average R2, the average number of observations, and factor-specific statistics, including t-statistic, beta (risk premium), p-value, and standard error.

From the results, we observe the following:

- The model exhibits a relatively low R2, indicating limited explanatory power, with approximately 98% of the variation in asset returns not explained by the factor and bp factors.

- The factor has a statistically significant positive effect on asset returns, with an estimated risk premium of 0.00195.

- The bp factor also shows a statistically significant positive effect on asset returns, with an estimated risk premium of 0.00110.

5. Performance evaluation

In this section, we compare the performance of the DolphinDB and Python under the same factor backtesting framework. For identical tasks, both the data sources and computational results are kept consistent across the two implementations.

| Task | DolphinDB | Python |

|---|---|---|

| Data Preprocessing | 1.141 s | 3.867 s |

| Single-Factor Analysis | 1.117 s | 8.306 s |

| Two-Factor Analysis | 1.673 s | 11.970 s |

| Variable Name | Description | Size (rows × columns) |

|---|---|---|

| factorTB | raw factor table | 796,203 × 3 |

| factorNew | preprocessed factor table | 739,908 × 3 |

| bpTB | raw bp table | 964,744 × 3 |

| bpNew | preprocessed bp table | 957,733 × 3 |

| benchmarkTB | market benchmark return table | 463 × 2 |

| bp_factorTB | combined bp and factor table | 745,059 × 4 |

| industryTB | industry classification table | 1,069,702 × 3 |

| mktmvTB | market capitalization table | 974,754 × 3 |

| retTB | return table | 793,802 × 3 |

The results show that DolphinDB achieves faster execution across all tested scenarios compared with Python.

6. factorBacktest Function Reference

6.1 Utility Functions

| Function | Syntax | Description |

|---|---|---|

dropNullRow |

dropNullRow(table) |

Remove rows containing null values from the table |

getPreviousFactor |

|

Retrieve the factor values from the previous period |

6.2 Data Preprocessing Functions

| Function | Syntax | Description |

|---|---|---|

delOutlier |

|

Remove outliers from the factor values |

standardize |

|

Standardize the factor values |

neutralize |

|

Neutralize the factor values with respect to market capitalization and industry |

preprocess |

|

Perform preprocessing on the factor values, including outlier removal, standardization, and neutralization |

6.3 Core Performance Metric Functions

| Function | Syntax | Description |

|---|---|---|

maxDrawdownNew |

maxDrawdownNew(returns) |

Calculate the maximum drawdown, expressed as a percentage, defined as ( 1 - current net value / historical peak net value) |

annualizedReturn |

annualizedReturn(returns,

period="DAILY") |

Calculate the annualized return |

annualizedVolatility |

annualizedVolatility(returns,

period="DAILY") |

Calculate the annualized volatility |

annualizedSharpe |

annualizedSharpe(returns, rf=0,

period="DAILY") |

Calculate the annualized Sharpe ratio, defined as ( (annualized return - risk-free rate) / annualized volatility) |

erAnnualReturn |

erAnnualReturn(returns, benchmarkReturns,

period="DAILY") |

Calculate the annualized excess return, defined as ( (1 + annualized strategy return) / (1 + annualized benchmark return) - 1 ) |

informationRatio |

informationRatio(returns, benchmarkReturns,

period="DAILY") |

Calculate the information ratio, defined as annualized excess return divided by the standard deviation of excess returns |

winRate |

winRate(returns, benchmarkReturns) |

Calculate the relative win rate versus the benchmark |

6.4 Factor Analysis Functions

| Function | Syntax | Description |

|---|---|---|

getFactorIc |

|

Calculate the factor IC (information coefficient) time series |

neweyWestCorrection |

neweyWestCorrection(x, y, maxLags) |

Apply the Newey-West correction to account for autocorrelation and heteroskedasticity |

neweyWestTest |

neweyWestTest(arr, factorName="factor",

maxLags=NULL) |

Calculate the mean of returns and output the Newey-West adjusted t-statistic and p-value |

analysisFactorIc |

|

Perform single-factor IC analysis |

riskAdjAlpha |

|

Calculate risk-adjusted factor alpha and its t-statistic |

famaMacbethReg |

|

Perform Fama-MacBeth regression |

6.5 Grouping and Portfolio Construction Functions

| Function | Syntax | Description |

|---|---|---|

getStockGroup |

|

Sort stocks by factor values and assign them into groups |

getGroupRet |

|

Calculate the returns for each stock group |

getGroupRetBacktest |

|

Calculate backtest metrics for each group’s returns |

analysisGroupRet |

|

Perform single-group factor analysis |

getDoubleSortGroup |

|

Categorize stocks into dependent double-sorted groups |

getDoubleSortGroupRet |

|

Calculate returns for dependent double-sorted groups |

doubleSortMean |

|

Calculate the mean returns for dependent double-sorted groups |

doubleSortBacktest |

|

Calculate backtest metrics for dependent double-sorted groups |

7. Summary

In this tutorial, we use the factorBacktest module to implement a

clear and practical factor evaluation framework built on DolphinDB. It covers key

stages of the quantitative factor research workflow, including factor data

processing, return analysis, and backtest result evaluation, ensuring comprehensive

and reliable analytical outcomes. As such, it serves as a robust and efficient tool

for quantitative factor research.

The current factorBacktest module has certain limitations. For

example, it does not yet support return computations for varying holding periods.

Future versions will expand functionality and improve flexibility to better support

practical quantitative research workflows.

8. Appendix

- factorBacktest module source: factorBacktest.dos

- Sample data: factor_backtest_data.zip

- Performance comparison scripts:

- References