Shark Graph and Snowball Option Pricing Case Study

In recent years, as Moore’s Law approaches its physical limits, the improvement of single-core processor performance has slowed significantly. Meanwhile, driven by the rapid development of technologies such as big data and artificial intelligence, computational demands are growing exponentially. To address this trend, using coprocessors such as GPU and FPGA for acceleration has become a new technological direction. This article introduces the Shark computation graph—a solution for accelerating DolphinDB scripts via a heterogeneous computing platform—and presents a case study on accelerating the snowball option pricing model.

1. Overview of Shark

Shark leverages GPU computing to accelerate compute-intensive analytics tasks, building on DolphinDB’s high-performance and stable storage system. The Shark platform currently supports three core components: GPLearn, DeviceEngine, and SharkGraph.

- GPLearn is a GPU-accelerated genetic algorithm module designed for factor mining.

- DeviceEngine focuses on accelerating factor computations using GPUs.

- SharkGraph is a general computing module that speeds up the execution of DolphinDB scripts.

2. Introduction to Shark Graph

Shark Graph enables acceleration for DolphinDB functions. To use it, simply annotate

the function with @gpu decorator, and it will automatically be

executed on the GPU. Here is an example:

@gpu

def factory1(x) {

sumX = sum(x)

if (sumX > 0) {

return sumX

} else {

return avg(x)

}

}

factory1(1..100)In this script, the user defines a custom factor function named

factory1 and annotates it with @gpu decorator.

When the function is executed, SharkGraph internally converts it into a computation

graph, transfers the arguments from system memory to GPU memory, executes the graph

using GPU-accelerated operators, and copies the result back to system memory for

user access.

Supported data types: BOOL, CHAR, SHORT, INT, LONG, FLOAT, DOUBLE.

Supported data structures: Scalar, Vector, Matrix(without indexes), and in-memory Table.

Supported syntax: A subset of DolphinDB syntax, including for loops,

if-else statements, break,

continue, assignments, and multi-variable assignments. SQL

syntax is not supported and must be rewritten as an equivalent function.

3. Snowball Option Pricing Using Shark Graph

While models such as Black-Scholes provide theoretical pricing for European options, snowball options are more complex due to features such as observation dates and knock-in/knock-out barriers, making them unsuitable for analytical pricing. In these cases, numerical methods such as Monte Carlo simulations are crucial.

Monte Carlo methods estimate the expected value of an option by randomly sampling the paths of the underlying asset's price. The accuracy of this method improves with the number of simulations. This section demonstrates how to optimize the Monte Carlo process for snowball option pricing using Shark Graph.

3.1 Overview of Snowball Option Pricing Algorithm

The snowball option is a type of exotic option whose payoff structure resembles a put option with barrier conditions. These barriers are critical components that determine when the option undergoes structural changes.

- Knock-out barrier: If the underlying asset's price exceeds a threshold, the option is terminated early and settled; if the threshold is not reached, the option continues to operate under its original terms.

- Knock-in barrier: If the asset price falls below a threshold, the option is activated with an agreed payoff structure; otherwise, it remains inactive.

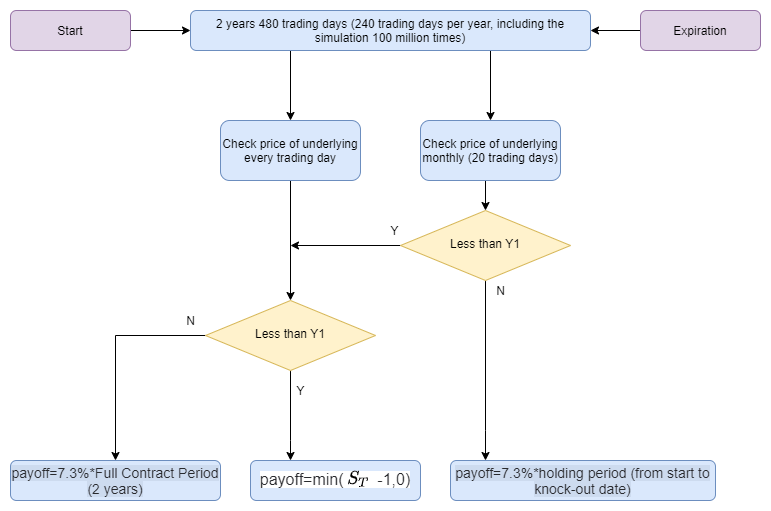

Figure 1 illustrates the pricing workflow.

Pricing Workflow:

- Assume there are 240 trading days per year, for a total of 480 trading days

including the start date. Perform Monte Carlo simulation with 1,000,000

paths. First, generate a matrix

zof size1000000*480filled with standard normally distributed random numbers. - Assume the initial stock price S0=1, volatility vol=13%, risk-free interest

rate r=3%, and dividend yield q=8%. Use the random number matrix

zto simulate stock price paths following the Geometric Brownian Motion.Initialize

s(:,1)=S0, and compute recursivelys(:,i+1) = s(:,i) * exp((r-q-vol^2/2)*(1/240)+vol*sqrt(1/240)*z(:,i)). - For each of the 1,000,000 simulation paths:

- Daily knock-in observation: If the stock price falls below Y2=0.7, the option is considered knocked in.

- Monthly knock-out observation: Every 20 trading days, check whether the stock price exceeds Y1=1.0.

Based on the snowball option rules, there are three possible outcomes:

- If a knock-out event occurs on any observation day, the holder

receives

payoff=7.3%*holding period (from start to knock-out date). - If the option neither knocks in nor knocks out during the 24-month

period, the holder receives

payoff=7.3%*Full Contract Period (2 years). - If the option is knocked in at some point but not knocked out by

maturity, the payoff is payoff=min(

-1,0), where

is the final price of the simulation path.

- After 1,000,000 simulations, record the status, holding period, and payoff for each path. Then, discount each payoff to present value. The final snowball option price is the average of these discounted payoffs.

- To ensure the accuracy of the computed price, calculate the option Greeks

using the finite difference method, including Delta, Gamma, Theta, Vega, and

Rho. Set

to 0.005.

The formula for calculating Delta is

, which means calculating the prices of snowball options with underlying prices

, respectively.

The full implementation of this pricing algorithm is provided in Appendix.

3.2 Accelerating the Pricing Algorithm with Shark Graph

Appendix 1 presents a script that utilizes

the ploop function to parallelize calculations and concatenate

results on the CPU. In contrast, Appendix

2 demonstrates how the same workload can be accelerated using Shark

Graph, which abstracts away the complexity of parallel programming by

automatically optimizing operator execution on the GPU.

The following tests evaluated the performance of snowball option pricing using Shark Graph and DolphinDB’s CPU-based parallel programming.

The test environment was configured as follows:

| Software/Hardware | Information |

|---|---|

| OS (Operating System) | CentOS Linux 7 (Core) |

| Kernel | 3.10.0-1160.el7.x86_64 |

| CPU Type | AMD EPYC 7513 32-Core Processor |

| Logical CPU Cores | 128 cores |

| Memory | 512 GB |

| GPU | NVIDIA A800 80GB PCIe |

This case study measured the execution time (in milliseconds) of snowball option pricing under different levels of concurrency and Monte Carlo iteration counts, comparing CPU-based and GPU-accelerated calculations.

The results are summarized in the table below:

| Concurrency | 1K Iter | 10K Iter | 100K Iter | 1M Iter |

|---|---|---|---|---|

| DolphinDB - 8 | 40.49 | 406.04 | 2,504.10 | 26,546.84 |

| DolphinDB - 16 | 13.21 | 244.60 | 1,464.68 | 14,306.35 |

| DolphinDB - 32 | 12.47 | 129.80 | 1,053.39 | 9,908.71 |

| DolphinDB - 64 | 11.61 | 99.57 | 779.49 | 7,742.04 |

| DolphinDB -128 | 27.38 | 63.39 | 577.26 | 6,213.23 |

| Shark Graph | 2.87 | 6.20 | 40.90 | 372.36 |

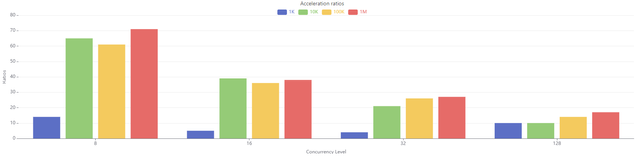

The acceleration ratios are shown in the Figure 2:

In large-scale simulations, Shark delivers a significant performance advantage over DolphinDB's CPU-based parallel execution. Compared to DolphinDB configured with 8 concurrent threads, Shark achieves up to a 70× acceleration. Even at moderate simulation scales, it consistently delivers over 60× acceleration. Although a single NVIDIA A800 GPU is approximately 9 to 10 times more expensive than a 32-core, 64-thread CPU, Shark outperforms DolphinDB running with 64 threads by a factor of 20×.

Therefore, for computation-intensive workloads, Shark's GPU acceleration providess a significantly more cost-effective solution.

4. Conclusion

This article presented a solution to accelerate DolphinDB scripts using the

heterogeneous computing platform Shark. By simply annotating target functions with

@gpu, users can seamlessly harness GPU acceleration with

minimal code changes. In the snowball option pricing case, Shark delivered up to 65×

acceleration compared to CPU-based concurrent execution. Even for moderately sized

Monte Carlo simulations, Shark achieved a 57× performance improvement.

5. Appendix

Appendix 1: DolphinDB script for snowball option pricing

// % Number of simulation paths

N = 1000000;

// % Underlying asset parameters

vol = 0.13;

S0 = 1;

r = 0.03;

q = 0.08;

// % Date parameters

days_in_year = 240; // trading days in a year

dt = 1\days_in_year; // one trading day

// % Barrier option (embedded snowball) parameters

T = 2; // term in years

Tdays = T * days_in_year; // term in trading days

Y1 = 1*S0; // knock-out level

Y2 = 0.8*S0; // knock-in level

observation_idx = 20 + 20*(0..(Tdays/20 - 1)) // observation days for knock-out, observed only on these days

all_t = dt + dt*(0..(T * days_in_year - 1))

St = 1;

// % Target return rate

profit = 0.003 * S0;

con_level = 100

def coupon(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, num){

days_in_year = 240; // trading days in a year

dt = 1\days_in_year; // one trading day

all_t = dt + dt*(0..int(T * days_in_year - 1))

Tdays = int(T * days_in_year); // term in trading days

S = St * exp((r - q - vol*vol/2) * repmat(matrix(all_t), 1, N) +

vol * sqrt(dt) * cumsum(norm(0,1,Tdays * N)$Tdays:N))

// status

knockout_matrix = S[observation_idx - 1, 0..(N - 1)] > Y1

status = iif(sum(S[observation_idx - 1, 0..(N - 1)] > Y1) > 0, 1,

iif(sum(S < Y2) == 0, -1, 0))

// t_holding (holding duration)

k = observation_idx * (S[observation_idx - 1, 0..(N - 1)] > Y1)

kk = iif(k == 0, NULL, k)

kkk = bfill(kk)

res = kkk[0,].flatten()

t_holding = all_t[res].nullFill!(double(T))

// pay_off

tmp_nag = min(0, last(S)/S0 - 1)

payoff = iif(status * t_holding > 0, status * t_holding,

iif(status * t_holding == 0, double(T), tmp_nag))

res = table(status, t_holding, payoff)

return res

}

def barrier_coupon(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, con_level){

con = int(N \ con_level)

nloop = 1..(con_level)

a = ploop(coupon{con, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit}, nloop).unionAll(false)

if (- profit * N - (exec sum(exp(-r * t_holding) * payoff) from a where status = -1) > 0){

C = (- profit * N - (exec sum(exp(-r * t_holding) * payoff) from a where status = -1)) /

(exec sum(exp(-r * t_holding) * payoff) from a where status != -1)

return C

}else{

C = 0

return C

}

}

def pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, num){

// % Date parameters

days_in_year = 240; // trading days in a year

dt = 1\days_in_year; // one trading day

all_t = dt + dt*(0..int(T * days_in_year - 1))

Tdays = int(T * days_in_year); // term in trading days

S = St * exp((r - q - vol*vol/2) * repmat(matrix(all_t), 1, N) +

vol * sqrt(dt) * cumsum(norm(0,1,Tdays * N)$Tdays:N))

// status

knockout_matrix = S[observation_idx - 1, 0..(N - 1)] > Y1

status = iif(sum(S[observation_idx - 1, 0..(N - 1)] > Y1) > 0, 1,

iif(sum(S < Y2) == 0, -1, 0))

// t_holding (holding duration)

k = observation_idx * (S[observation_idx - 1, 0..(N - 1)] > Y1)

kk = iif(k == 0, NULL, k)

kkk = bfill(kk)

res = kkk[0,].flatten()

t_holding = all_t[res].nullFill!(double(T))

// pay_off

tmp_nag = min(0, last(S)/S0 - 1)

payoff = iif(status * t_holding > 0, C * status * t_holding,

iif(status * t_holding == 0, C * double(T), tmp_nag))

res = table(status, t_holding, payoff)

return res

}

def barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, con_level){

con = int(N \ con_level)

nloop = 1..(con_level)

a = ploop(pricing{con, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C}, nloop).unionAll(false)

price = mean(exp(-r * a.t_holding) * a.payoff)

return price

}

timer C = round(barrier_coupon(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit * S0, con_level), 3)

if (C > 0){

timer price_St_plus = barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St * (1 + 0.005), profit, C, con_level);

timer price_St_minus = barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St * (1 - 0.005), profit, C, con_level);

timer price_vol_plus = barrier_pricing(N, vol + 0.01, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, con_level);

timer price_vol_minus = barrier_pricing(N, vol - 0.01, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, con_level);

timer price_after_oneday = barrier_pricing(N, vol, S0, r, q, T - dt, Y1, Y2, observation_idx - 1, St, profit, C, con_level);

timer price = barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, con_level);

timer delta = (price_St_plus - price_St_minus) / 2 / St / (St * 0.005);

timer gamma = (price_St_plus - 2 * price + price_St_minus) / St / St / (St * 0.005)^2;

timer vega = (price_vol_plus - price_vol_minus) / 2 / 0.01;

timer theta = (price - price_after_oneday) / dt;

}

else {

price = NULL

delta = NULL

gamma = NULL

vega = NULL

theta = NULL

}Appendix 2: Script for snowball option pricing using Shark Graph

// % Number of simulation paths

N = 1000000;

// % Underlying asset parameters

vol = 0.13;

S0 = 1;

r = 0.03;

q = 0.08;

// % Date parameters

days_in_year = 240; // Trading days in one year

dt = 1\days_in_year; // One trading day

// % Barrier option (embedded snowball) parameters

T = 2; // Option term in years

Tdays = T * days_in_year; // Term in trading days

Y1 = 1 * S0; // Knock-out price

Y2 = 0.8 * S0; // Knock-in price

observation_idx = 20 + 20 * (0..(Tdays / 20 - 1)) // Observation days (check knock-out only on these dates)

all_t = dt + dt * (0..(T * days_in_year - 1))

St = 1;

// % Target yield rate

profit = 0.003 * S0;

con_level = 100

def coupon(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit){

days_in_year = 240; // Trading days in one year

dt = 1\days_in_year; // One trading day

all_t = dt + dt * (0..int(T * days_in_year - 1))

Tdays = int(T * days_in_year); // Term in trading days

S = St * exp((r - q - vol * vol / 2) * repmat(matrix(all_t), 1, N) +

vol * sqrt(dt) * cumsum(norm(0, 1, Tdays * N) $ Tdays:N))

// Determine status

knockout_matrix = S[observation_idx - 1, 0..(N - 1)] > Y1

status = iif(sum(knockout_matrix) > 0, 1, iif(sum(S < Y2) == 0, -1, 0))

// Holding period

k = observation_idx * (knockout_matrix)

kk = iif(k == 0, NULL, k)

kkk = bfill(kk)

res = kkk[0,].flatten()

t_holding = all_t[res].nullFill(double(T))

// Payoff

statusxtholdings = status * t_holding

tmp_nag = min(0, last(S)/S0 - 1)

payoff = iif(statusxtholdings > 0, statusxtholdings,

iif(statusxtholdings == 0, double(T), tmp_nag))

res = table(status, t_holding, payoff)

index = res.status == -1

aut = res.payoff[index]

sum1 = sum(exp(-r * res.t_holding[index]) * res.payoff[index])

if (-profit * N - sum1 > 0){

index2 = res.status != -1

sum2 = sum(exp(-r * res.t_holding[index2]) * res.payoff[index2])

C = (-profit * N - sum1) / sum2

return C

} else {

return 0

}

}

// fn = createSharkGraph(snowRun)

// fn.genGraphDotFile("/home/jpma/testDB/release300.graph/build/dos/1.dot")

// fn.dumpGraphCode("/home/jpma/testDB/release300.graph/build/dos/D20-20840.rewrite.dos")

def pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, num){

// % Date parameters

days_in_year = 240; // Trading days in one year

dt = 1\days_in_year; // One trading day

all_t = dt + dt * (0..int(T * days_in_year - 1))

Tdays = int(T * days_in_year); // Term in trading days

S = St * exp((r - q - vol * vol / 2) * repmat(matrix(all_t), 1, N) +

vol * sqrt(dt) * cumsum(norm(0, 1, Tdays * N) $ Tdays:N))

// Determine status

knockout_matrix = S[observation_idx - 1, 0..(N - 1)] > Y1

status = iif(sum(knockout_matrix) > 0, 1, iif(sum(S < Y2) == 0, -1, 0))

// Holding period

k = observation_idx * (knockout_matrix)

kk = iif(k == 0, NULL, k)

kkk = bfill(kk)

res = kkk[0,].flatten()

t_holding = all_t[res].nullFill(double(T))

// Payoff

statusxtholdings = status * t_holding

tmp_nag = min(0, last(S)/S0 - 1)

payoff = iif(statusxtholdings > 0, C * statusxtholdings,

iif(statusxtholdings == 0, C * double(T), tmp_nag))

res = table(status, t_holding, payoff)

return res

}

def barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C){

res = pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C, 1)

return mean(exp(-r * res.t_holding) * res.payoff)

}

@gpu

def snowRun(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, con_level, dt) {

C = round(coupon(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit * S0), 3)

if (C > 0) {

price_St_plus = barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St * (1 + 0.005), profit, C);

price_St_minus = barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St * (1 - 0.005), profit, C);

price_vol_plus = barrier_pricing(N, vol + 0.01, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C);

price_vol_minus = barrier_pricing(N, vol - 0.01, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C);

price_after_oneday = barrier_pricing(N, vol, S0, r, q, T - dt, Y1, Y2, observation_idx - 1, St, profit, C);

price = barrier_pricing(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, C);

delta = (price_St_plus - price_St_minus) / 2 / St / (St * 0.005);

gamma = (price_St_plus - 2 * price + price_St_minus) / St / St / (St * 0.005)^2;

vega = (price_vol_plus - price_vol_minus) / 2 / 0.01;

theta = (price - price_after_oneday) / dt;

} else {

price = 1

delta = NULL

gamma = NULL

vega = NULL

theta = NULL

}

return price

}

timer {

a1 = snowRun(N, vol, S0, r, q, T, Y1, Y2, observation_idx, St, profit, con_level, dt)

}