DolphinDB-Based Solution for Quantitative Cryptocurrency Trading

1. Overview

In recent years, the global cryptocurrency market has grown rapidly. The proliferation of exchanges and cryptocurrency types, round-the-clock trading, massive trading volumes, and high price volatility have created unprecedented opportunities for quantitative cryptocurrency trading firms. At the same time, the complexity of the cryptocurrency market brings significant technical challenges. First, data sources are highly scattered and data structures are complex, leading to high costs for data ingestion and management. Second, high-frequency trading generates massive volumes of data, placing extremely high demands on database performance. Third, the separation between strategy research and live trading systems makes it difficult to directly apply research findings to live trading. Against this backdrop, building a high-performance, low-latency, and scalable integrated quantitative trading platform has become a core competitive advantage for quantitative cryptocurrency trading firms.

Tailored to the cryptocurrency market, DolphinDB delivers an end-to-end trading solution that combines high-performance distributed storage and computing, low-latency streaming processing, backtesting, and order matching. The solution covers the full workflow from data storage and processing to strategy development and live trading, helping trading firms accelerate strategy development and validation. Key features of the solution include:

- Comprehensive solution for ingesting and storing market data from Binance and OKX, along with a monitoring and alerting mechanism that significantly reduces data maintenance costs.

- Built-in data cleansing and processing functions that eliminate tedious preprocessing steps, lower the barrier to strategy development, and accelerate strategy implementation.

- Batch and streaming factor computation, integrated with Python-based training models to generate factor signals in real time.

- A live trading module with the same usage as the DolphinDB backtesting plugin, allowing high-performing strategies to be directly deployed in live trading.

In addition, the solution includes real-time risk control models for key risk metrics, enabling real-time monitoring and alerting of account risk to help manage risk effectively. It also extends to features such as strategy code management and user management.

Version requirements: We recommend that you use DolphinDB Server 3.00.4 to implement the solution.

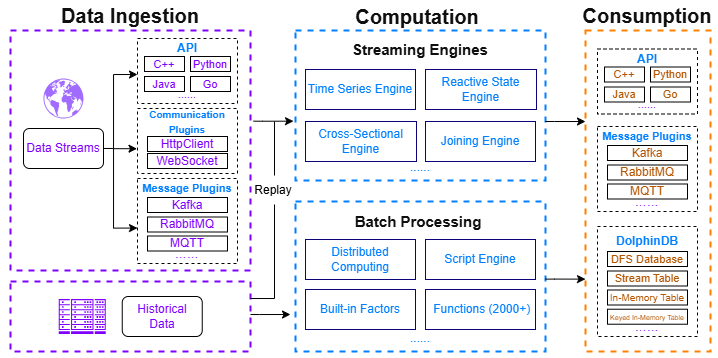

1.1 Market Data Processing

In quantitative trading research, market data is the core for strategy development, factor construction, backtesting, simulated trading, and live trading. DolphinDB integrates a high-performance distributed storage engine with a streaming computation framework, enabling efficient storage and batch processing of massive data while also supporting real-time computation and persistence of streaming data. The processing workflow for cryptocurrency market data is divided into three parts: data ingestion, computation, and consumption.

Data ingestion: This solution integrates data sources from two major cryptocurrency exchanges—Binance and OKX. For different data types, it provides best-practice database and table designs, covering tick data, trading data, OHLC data, funding rate data, liquidation data, and more (see Chapter 2 for details). In addition, it supports customizing the cryptocurrency list to meet diverse data requirements. DolphinDB supports acquiring trading data through the following tools:

- APIs: APIs for multiple programming languages, including Python, C++, Java, and Go.

- Plugins: Data communication plugins such as httpClient and WebSocket.

To address issues such as network interruptions, exchange API errors, and database errors, this solution provides a comprehensive monitoring, alerting, and data backfill mechanism to prevent data loss. The specific methods include:

- Writing real-time streaming data to stream tables on two servers simultaneously, with key-based deduplication to mitigate the impact of network disruptions.

- Automatically retrying connections upon abnormal disconnections, caching data locally, and reloading them into the database once the connection is restored.

- Periodically monitoring the status of stream tables and databases, and triggering alerts promptly when anomalies are detected.

- Periodically validating the completeness of OHLC data for the previous trading day and re-fetching missing data when necessary.

Computation: DolphinDB provides a powerful computation framework that supports both batch and streaming processing, including real-time snapshot aggregation, batch and real-time factor computation, and real-time data storage into databases.

- Streaming engines: DolphinDB provides multiple built-in streaming engines, such as the time-series engine (e.g., used to generate OHLC bars at different frequencies), the reactive state engine (e.g., used to cleanse data in real time), join engines (e.g., used to aggregate snapshot data), and the cross-sectional engine (e.g., used to rank cryptocurrency types).

- High-performance batch processing: DolphinDB supports distributed batch processing and comes with multiple factor libraries and more than 2,000 optimized functions. Its powerful programming language enables efficient processing and analysis of large-scale datasets.

Consumption: Results computed by DolphinDB can be stored in DFS tables, in-memory tables, or stream tables. Consumers can subscribe to stream tables in real time to obtain the latest market data for simulated or live trading. Alternatively, computation results can be accessed in real time through APIs or pushed via message middleware.

1.2 Unified Stream and Batch Processing

In quantitative trading research, factor research is a critical part of strategy development. Factors are quantitative metrics that capture market characteristics and reflect price dynamics and risk structures, forming the foundation of model prediction and signal generation.

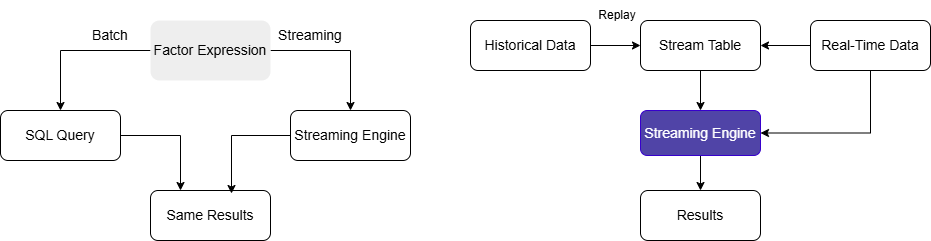

Traditional quantitative research platforms often adopt a dual-system architecture: using scripting languages like Python for strategy and factor development, and high-performance languages such as C++ for real-time computation in production. This approach not only incurs high development and maintenance costs, but also risks inconsistencies between batch and streaming results.

DolphinDB’s unified stream and batch processing framework eliminates this issue by enabling a single codebase that allows seamless migration of factor logic from development to real-time computation. This ensures consistent results between research and live trading while significantly reducing development costs and maintenance complexity.

Based on DolphinDB’s built-in 191 Alpha and WorldQuant 101 Alpha factor libraries, this solution supports both batch and streaming computations for these factors, along with a highly extensible factor storage architecture. User-defined factors can also be developed as needed.

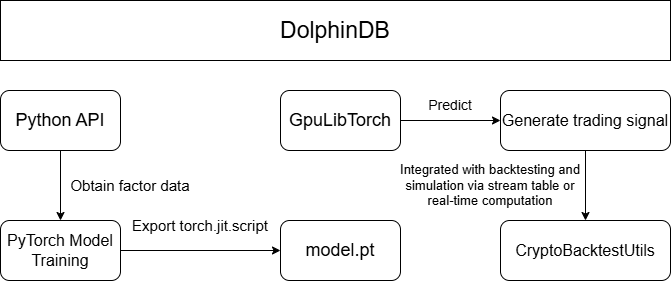

On this foundation, machine learning models, such as LSTM, XGBoost, and Transformer, are trained on existing factors in a Python environment, with full support for data access, preprocessing, and model training. Trained models can be loaded into DolphinDB via the GpuLibTorch plugin for backtesting and simulated trading, enabling real-time trading signal generation. Leveraging these capabilities, this solution delivers an end-to-end pipeline from factor development and streaming-batch computation, to Python-based model training and real-time trading signal generation.

1.3 Backtesting and Simulated Trading

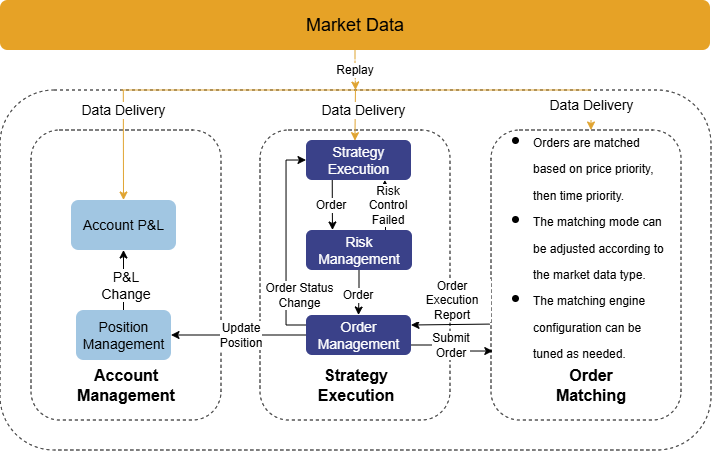

Before being deployed in live trading, quantitative strategies are subjected to extensive backtesting and simulation to validate their effectiveness and feasibility. DolphinDB provides a comprehensive backtesting and simulation framework for cryptocurrency quantitative trading, featuring core components such as historical market data replay, real-time data ingestion, an order matching simulator, and a backtesting engine.

- Historical data replay: In simulated trading, quantitative strategies

usually process real-time data in an event-driven manner. To ensure

consistent strategy logic across backtesting and simulated trading,

DolphinDB provides a data replay mechanism that feeds historical market data

into the backtesting engine in strict chronological order, reproducing real

trading conditions.

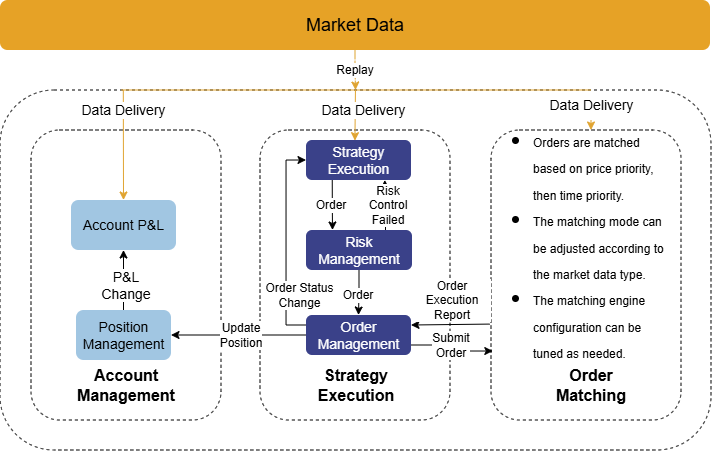

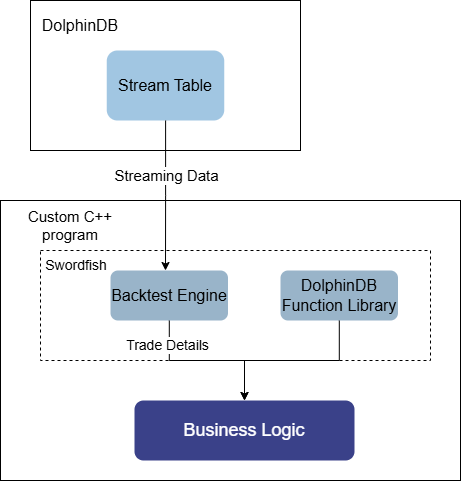

Figure 4. Figure 1-4: Cryptocurrency Backtesting Architecture - Real-time data ingestion: In simulated trading, the DolphinDB backtesting engine supports continuous ingestion of streaming data. During execution, results such as trade details, real-time positions, and account equity are written to stream tables in real time.

- Backtesting plugin: The DolphinDB backtesting plugin includes a built-in order matching simulator optimized to reflect real-world matching logic, enabling more accurate evaluation and prediction of strategy performance in live trading. The plugin consists of four core components: user-defined strategy functions, strategy configuration and creation, market data replay, and execution of the backtesting engine. It supports snapshot and minute-level cryptocurrency market data, as well as multi-account management.

To reduce strategy development costs, we focus on real-world quantitative trading requirements to provide an integrated backtesting and simulation solution. The solution unifies market data replay and processing, backtesting and simulation engine creation, strategy development and code management, strategy visualization and management, and user-level strategy permission control. This allows developers to focus solely on strategy logic, enabling both individual users and quantitative trading teams to conduct efficient research and development with minimal code and a low learning curve.

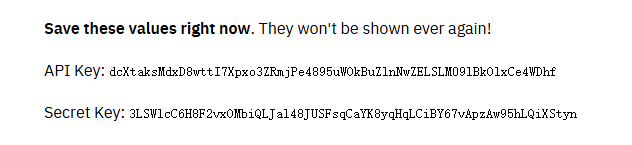

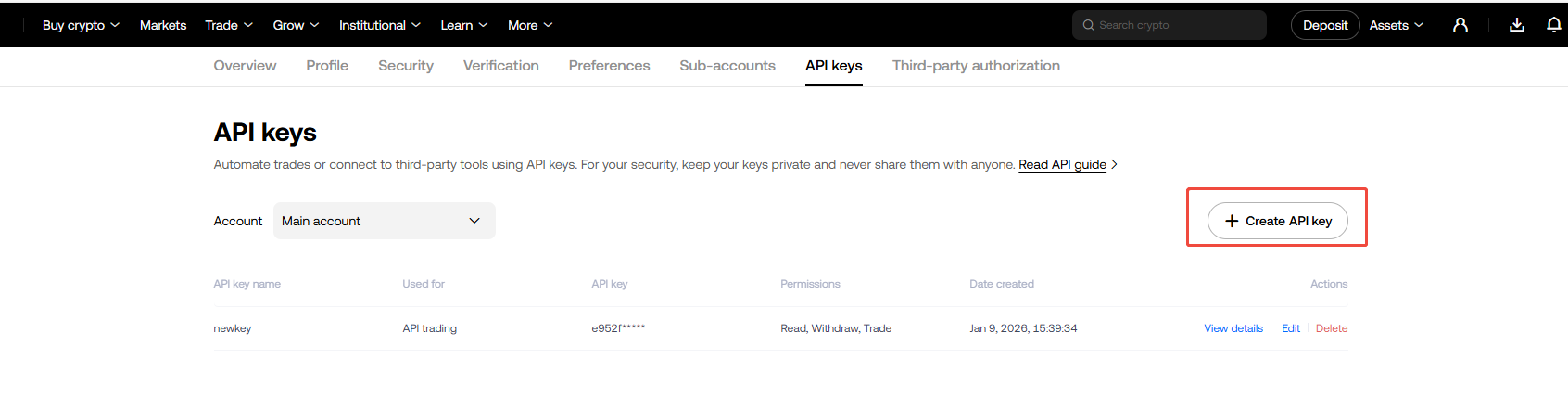

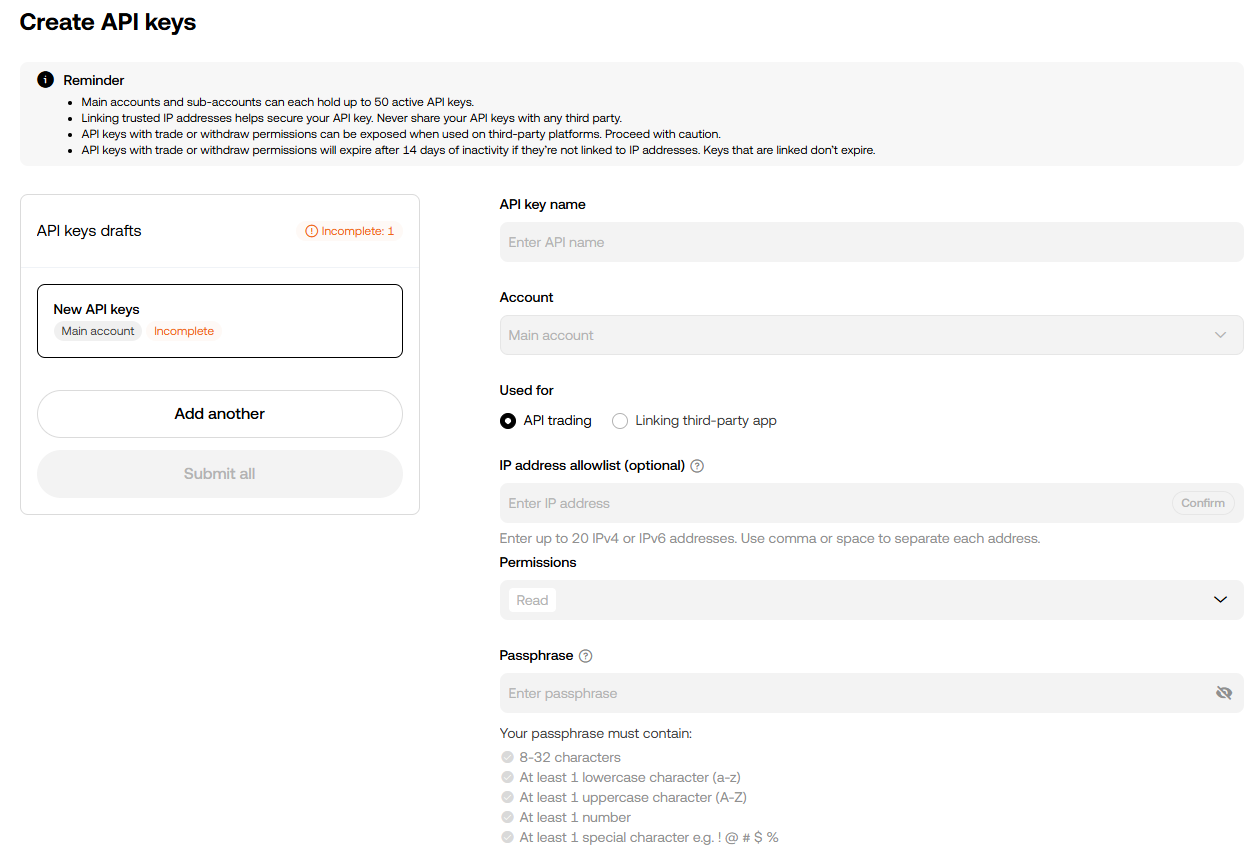

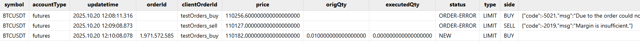

1.4 Live Trading

After thorough backtesting and simulation, strategy researchers aim to deploy high-performing strategies in live cryptocurrency markets to generate real returns. To support this transition, this solution integrates with exchange order and account APIs and provides a live trading module fully consistent with the simulation logic. This enables a true “single codebase” approach across backtesting, simulation, and live trading. This solution supports both Binance and OKX, offering capabilities such as order placement and cancellation, querying open orders, and retrieving trade details. In addition, it incorporates risk metrics to build real-time risk control models for timely monitoring and alerting of account conditions.

1.5 Real-Time Risk Control

The cryptocurrency market is highly volatile, offering significant return potential alongside substantial risk. In practice, many existing solutions compute risk metrics by directly consuming exchange-provided fields such as margin usage and unrealized profit and loss (P&L). Although simple, this approach has several limitations:

- Risk data provided by exchanges often has low update frequency or high latency, making it difficult to promptly reflect risks caused by rapid market movements.

- It does not support portfolio-level risk computation across multiple accounts.

- It cannot be combined with simulated market data for scenario analysis and stress testing.

To address these issues, we provide a DolphinDB-based real-time risk control solution for cryptocurrency trading. By continuously ingesting exchange account data and periodically computing key metrics such as portfolio’s net asset value, position P&L, total asset value, and leverage ratio, this solution enables timely monitoring and alerting of account risk, helping investors better understand and manage their investment risks. Compared with traditional risk control approaches, this solution offers the following advantages:

- Stronger real-time performance: Compared with exchange-provided leverage estimates, this solution captures market changes promptly and issues real-time risk alerts, ensuring superior timeliness.

- Real-time data persistence: Account information and risk metrics are persisted in real time, enabling advanced analysis, scenario simulation, and stress testing.

- High extensibility: You can flexibly modify and extend risk metric computation to meet diverse risk management requirements across different scenarios.

- Isolation from business logic: The risk control module operates independently from trading logic and runs on read-only account data, ensuring the stability and continuity of the trading system.

2. Historical and Real-Time Data Ingestion

Unlike traditional financial assets, the cryptocurrency market operates with round-the-clock trading, high price volatility, and massive data volumes. These characteristics place much higher demands on database performance, including data storage, querying, and real-time processing. To address these challenges, we leverage DolphinDB’s high-performance storage and computing capabilities to provide a comprehensive solution for data ingestion and storage, data processing, as well as monitoring and data backfill.

This solution integrates two major exchanges (Binance and OKX) as data sources. It supports a wide range of cryptocurrency types and various market data to meet diverse requirements. For certain data types, different modes can be selected (USD-margined, coin-margined, or spot). In addition, this solution implements robust fault-tolerance mechanisms, including automatic reconnection retries, scheduled monitoring, and periodic data backfill, ensuring data completeness and reliability even in scenarios such as network failures or service restarts.

Below is a summary table of all provided market data ingestion scripts, covering both historical and real-time data. The complete data ingestion scripts are included in the Appendix. Exchange-related documentation can be found at: Binance Open Platform and OKX API Guide.

| Data type | Table Type/Name | Script File Name | Description |

|---|---|---|---|

| OHLC data |

|

|

Supports ingesting historical and real-time data to generate OHLC bars at different frequencies.To add new frequencies or modify table names, see Sections 2.2 & 2.3. |

| Tick trade data |

|

|

|

| Aggregated trade data |

|

|

OKX does not provide historical aggregated trade data. |

| Level 2 market data |

|

Real-time data:

|

No historical data. |

| Snapshot market data |

|

Real-time data: depthTradeMergeScript.dos | Merged in real time from level 2 data and aggregated trade data, and persisted in real time. |

| 400-level order book snapshot data |

|

Real-time data: okx_depth_400.py | After retrieving both full and incremental snapshots, the data is processed by the orderbook snapshot engine and persisted in real time. |

| Funding rate data | DFS table: dfs://CryptocurrencyDay/fundingRate |

|

|

| Index price/ mark price OHLC | DFS table:

|

Historical data: historyIndexMarkKLine.py | Not pushed in real time and is retrieved on a scheduled basis, following the funding rate scheduling logic. |

| Metrics data | DFS table: dfs://CryptocurrencyKLine/metrics | Historical data: historyMetrics.py |

|

| Minute-level data for continuous contracts |

|

Real-time data:

|

No historical data. |

| Liquidation data |

|

Real-time data:

|

|

| Trading pair information |

|

Real-time data:

|

No historical data. |

- Binance internally maintains multiple types of historical market data. For details, see Binance Data Collection.

- Instructions for using the historical and real-time data ingestion scripts are provided in Sections 2.2 & 2.3.

2.1 Database and Table Schema

Considering the characteristics of cryptocurrency market data and its usage scenarios, we provide partitioning schemes based on both OLAP and TSDB engines to achieve optimal performance for data ingestion and querying. Taking nine major cryptocurrencies as examples, this section describes the database and table design by combining minute-level OHLC data, tick data, funding rate data, and other datasets. The design supports a certain level of extensibility for additional symbols and is reasonably generic. The database and table creation scripts are provided in the Appendix.

| Database Name | Engine | Partitioning Scheme | Partition Column | Sorting Column | Data Type |

|---|---|---|---|---|---|

| CryptocurrencyTick | TSDB | Daily partition + HASH partition by symbol | Trade time + symbol | Exchange + symbol + trade time |

|

| CryptocurrencyOrderBook | TSDB | Hourly partition + VALUE partition by symbol | Trade time + symbol | Symbol + trade time | High-frequency order book snapshot data (400 levels) |

| CryptocurrencyKLine | OLAP | Yearly partition | Trade time | None |

|

| CryptocurrencyDay | OLAP | 5-year partition | Trade time | None |

|

- For precise database and table design, you need to consider both the data volume of selected cryptocurrencies and their usage scenarios.

- Low-frequency and infrequently queried data, such as funding rate data and liquidation data, are stored in dimension tables.

This solution integrates market data types from both Binance and OKX. For different data types, unified field naming conventions are adopted while preserving exchange-specific fields as much as possible. All timestamp fields use Beijing Time (UTC +8). A complete field description is provided in the Appendix.

2.2 Historical Data Ingestion

This solution provides a complete set of scripts for ingesting historical data, including OHLC data at different frequencies, aggregated trade data, tick trade data, funding rate data, and metrics data. You can specify time ranges, cryptocurrency list, and frequencies (for OHLC data). Historical market data is primarily used for backtesting and data monitoring. Therefore, we recommend that you do not customize database or table names. Otherwise, corresponding table names in scripts need to be modified. In addition, there are differences between the historical data provided by Binance and OKX. Detailed description can be found in the Description column of Table 2-1. The complete historical data ingestion scripts are provided in the Appendix.

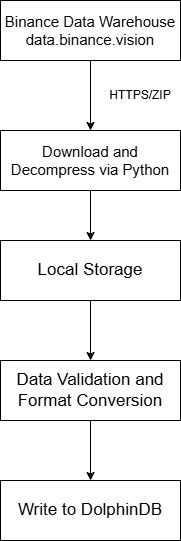

2.2.1 Historical Data Ingestion for Binance

Overview

This solution uses Python to batch-download historical data from Binance and import it into DolphinDB. By accessing Binance’s official historical data warehouse, it supports batch processing across multiple trading pairs and date ranges, and includes error handling, logging, and data validation.

- Data source: Access Binance’s official historical data warehouse to view all available assets and the corresponding start dates.

- Data download: Use the requests library to download compressed CSV files, decompress them, and retain the raw data. After successful write, the original files are deleted.

- Data write: Connect to DolphinDB and write the data into the target DFS tables.

- Logging: Record write details, including download status, parsing status, and the number of rows written.

- Workflow control: Support customizing the cryptocurrency list and start/end dates, and automatically iterating over the ingestion workflow.

Core functions

download_file: Downloads the compressed file for a specified date to a given path, decompresses it, removes the .zip file, and returns the CSV file path.parse_csv_to_dataframe: Reads the CSV file, checks for the presence of headers, converts fields to match the required data types for data write, and returns a standardized pandas.DataFrame.import_to_db: Writes the transformed DataFrame into the specified DolphinDB table.process_single_file: Chains the above three functions to process the historical data of a single cryptocurrency for a single day.run: The main control function that iterates in batch over multiple cryptocurrencies and multiple dates, recording overall results.

Variables and usage instructions

Before running, ensure that the target database and tables exist in the DolphinDB server. Modify the following variables according to your requirements and execute the Python program. The Python script is provided in the Appendix.

| Variable | Location | Description |

|---|---|---|

| DDB | config.py | Configures the DolphinDB connection, including host, port, username, and password |

| HIS_CONFIG | config.py | Directory for storing import logs |

| HIS_CONFIG | config.py | Directory for storing downloaded files |

| PROXY | config.py | Proxy address |

| url | In download_file() | URL of the file to download. Adjust as needed;

/futures and /spot

distinguish futures and spot addresses |

| symbols | Configuration parameter | List of symbols for which historical data is downloaded, e.g. ["BTCUSDT"] |

| start_date | Configuration parameter | Start time of the historical data to download |

| end_date | Configuration parameter | End time of the historical data to download |

| db_path | Configuration parameter | Target database path for data import |

| table_name | Configuration parameter | Name of the target DFS table |

| accountType | Configuration parameter | Contract type (varies by data type):

|

| interval | Configuration parameter | OHLC frequency (OHLC data only): '1m', '3m', '5m', '15m', '30m', '1h', '2h', '4h', '6h', '8h', '12h', '1d', '3d', '1w', '1mo' |

| klineType | Configuration parameter | OHLC type (index or mark price only):

|

The following example shows how to import Binance’s historical minute-level OHLC data using historyKline.py. You can reference this example and modify the parameters to import other types of market data.

- Create the required database and tables for the data type. We recommend

that you do not modify table names. For the full script, refer to

createDatabase.dos in the Appendix.

dbName = "dfs://CryptocurrencyKLine" tbName = "minKLine" streamtbName = "Cryptocurrency_minKLineST" db = database(dbName, RANGE, 2010.01M + (0..20)*12) colNames = `eventTime`collectionTime`symbolSource`symbol`open`high`low`close`volume`numberOfTrades`quoteVolume`takerBuyBase`takerBuyQuote`volCcy colTypes = [TIMESTAMP, TIMESTAMP, SYMBOL, SYMBOL, DOUBLE, DOUBLE, DOUBLE, DOUBLE, DOUBLE, INT, DOUBLE, DOUBLE, DOUBLE, DOUBLE] createPartitionedTable(db, table(1:0, colNames, colTypes), tbName, `eventTime) - Install required Python packages such as requests, zipfile, numpy, and dolphindb.

- Modify variables as

needed:

# config.py -- DDB and PROXY must be updated for your setup DDB = {"HOST": '192.xxx.xxx.xx', "PORT": 8848, "USER": 'admin', "PWD": '123456'} BINANCE_BASE_CONFIG = { "PROXY": 'http://127.0.0.1:7890/', "TIMEOUT": 5, "PROBE_COOLDOWN_SECS": 30, "READ_BATCH_SIZE": 20000, "LIVE_GET_TIMEOUT": 0.2 } HIS_CONFIG = {"LOG_DIR": "./logs", "SAVE_DIR": "./data"} # Global settings symbols = ["BTCUSDT","ETHUSDT","ADAUSDT","ALGOUSDT","BNBUSDT","FETUSDT","GRTUSDT","LTCUSDT","XRPUSDT"] start_date = datetime(2025, 8, 11) end_date = datetime(2025, 8, 12) accountType = "um" # Supported: um/cm/spot interval = "1m" # Adjust for different OHLC frequencies db_path = "dfs://CryptocurrencyKLine" table_name = "minKLine" - Execute the Python script to batch-import historical data. Import

progress and results can be monitored via the log files at the custom

LOG_DIR

path.

result = downloader.run(accountType, symbols, klineType, start_date, end_date, interval, db_path, table_name)

2.2.2 Historical Data Ingestion for OKX

Unlike Binance, OKX does not provide a historical data warehouse; historical data can only be accessed via the API. Additionally, due to OKX’s rate limits, concurrent requests across multiple cryptocurrencies are not feasible. Therefore, this solution uses the httpClient plugin to sequentially call the API by trading pair and date to fetch historical data.

Core functions

convertOKXSymbol: Symbol conversion function that converts OKX-formatted symbols (e.g., 'BTC-USDT-SWAP') to standard format (e.g., 'BTCUSDT').getOKXHistoryKLineOne: Single API request that returns parsed data and the earliest timestamp.insertKLines: Data insertion function that returns the number of inserted rows and a stop flag.getHistoryKLine: Main function that retrieves historical data sequentially by trading pair and date, printing import status.

Variables and usage instructions

Before running, ensure the target database and tables exist in the DolphinDB server. Modify the following variables according to your requirements and execute the DOS script. The full script is provided in the Appendix.

| Variable | Location | Description |

|---|---|---|

| dbName | Configuration parameter | Path to the target database |

| tbName | Configuration parameter | Name of the target DFS table |

| proxy_address | Configuration parameter | Proxy server address |

| codes | Configuration parameter | List of symbols; syntax differs by type:

|

| startDate | Configuration parameter | Start date of historical data |

| endDate | Configuration parameter | End date of historical data |

| bar | Script for OHLC data: okx_historyKLine.dos | OHLC frequency (OHLC data only): '1s', '1m', '3m', '5m', '15m', '30m', '1H', '2H', '4H', '6Hutc', '12Hutc', '1Dutc', '2Dutc', '3Dutc', '1Wutc', '1Mutc', '3Mutc' |

| klineType | Script for OHLC data: okx_historyKLine.dos | OHLC data type:

|

The following example shows how to import OKX’s historical minute-level OHLC data using okx_historyKline.dos. You can modify the parameters to import other types of market data.

- Create the required database and tables. We recommend that you do not modify table names. For the full script, refer to createDatabase.dos in the Appendix.

- Install and load the httpClient plugin in

DolphinDB:

login("admin", "123456") // Log in listRemotePlugins() // List available plugins installPlugin("httpClient") // Install the httpClient plugin loadPlugin("httpClient") // Load the httpClient plugin - Modify variables as

needed:

dbName = "dfs://CryptocurrencyKLine" tbName = "minKLine" proxy_address = 'http://127.0.0.1:7890' codes = ["BTC-USDT-SWAP","ETH-USDT-SWAP","ADA-USDT-SWAP","ALGO-USDT-SWAP","BNB-USDT-SWAP", "FIL-USDT-SWAP","GRT-USDT-SWAP","LTC-USDT-SWAP","XRP-USDT-SWAP"] startDate = 2025.10.01 endDate = 2025.10.01 - Run the DOS script to batch-import historical OKX

data:

getHistoryKLine(startDate, endDate, codes, dbName, tbName, proxy_address, bar='1m', KLineType="kline")

The output displays the import status. You can also call

submitJob to run the job in the background:

submitJob("getHistoryKLine", "Fetch OKX historical K-line data",

getHistoryKLine, startDate, endDate, codes, dbName, tbName, proxy_address, '1m', "kline")2.3 Real-Time Data Ingestion

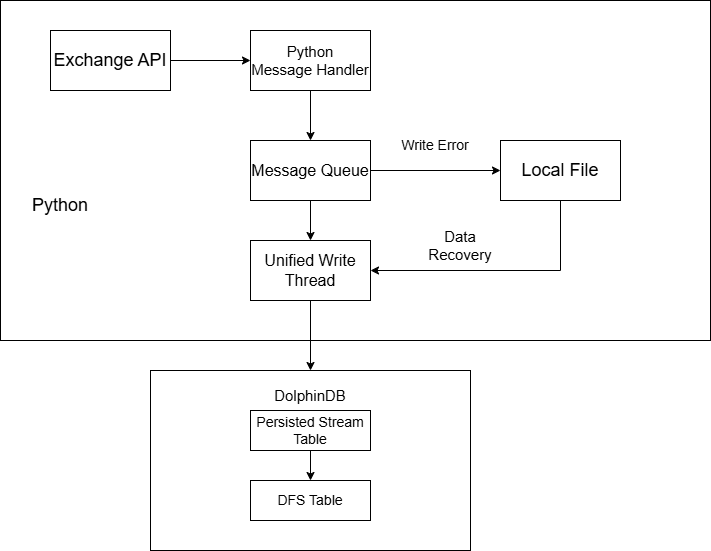

This solution provides a complete set of scripts for ingesting real-time data, including OHLC data at different frequencies, minute-level data for continuous contracts, level 2 market data, aggregated trade data, tick trade data, liquidation data, and trading pair information. You can specify the cryptocurrency list. Real-time stream tables are used for backtesting, simulated trading, and data monitoring. Therefore, we recommend that you do not customize stream table names. Otherwise, corresponding table names in scripts need to be modified. In addition, there are differences between the real-time data provided by Binance and OKX. Detailed description can be found in the Description column of Table 2-1. If resources are sufficient, dual-channel real-time data ingestion is recommended to ensure data completeness.

2.3.1 Overview

This solution allows you to subscribe to real-time data for specified cryptocurrency trading pairs via WebSocket. It uses MultithreadedTableWriter (MTW) to batch-write data into DolphinDB’s persistent stream tables, and then persists the data into databases by subscribing to these stream tables. The system supports automatic reconnection, exception recovery, and data backfill. If a database exception occurs, it automatically switches to local file caching. With dual-channel ingestion enabled, the system can tolerate a network interruption on one channel and ensure zero data loss.

- Data sources: Real-time data is subscribed via Python’s WebSocket library.

binance.websocket.um_futures.websocket_client: subscribes to Binance futures data;binance.websocket.spot.websocket_stream: subscribes to Binance spot data;okx.websocket.WsPublicAsync: subscribes to OKX data.

- Ingestion side: The main process starts the WebSocket client, initializes the writer, and launches a daemon thread to monitor data reception.

- Caching side: A single IOThread handles all write operations to avoid out-of-order writes.

- Write side: Data is written to stream tables via MTW provided by DolphinDB API and then persisted into corresponding partitioned tables through subscriptions.

- Fault tolerance: If the WebSocket client disconnects, the system continuously attempts reconnection. If writing fails, data is written to local JSON files. After the writer restarts, cached data is automatically read and backfilled into DolphinDB.

The collectionTime field in stream tables represents the local timestamp when real-time data is collected and can be used to analyze subscription latency.

2.3.2 Core Components

- _framework.py: General framework for data ingestion.

- xxxBaseConfig: Base configuration class defining common settings such as DolphinDB connection, proxy configuration, real-time queues, and cache files. It also provides methods for workflow startup, timeout monitoring, etc.

- IOThread: A common class that centrally manages the single write

path for MTW writing, local persistence, and data backfill,

executing serially to avoid disorder. It has following three states:

- live: DolphinDB is healthy; data is taken from the real-time queue and written via MTW.

- offline: DolphinDB is unavailable; real-time queue data is persisted locally as much as possible, then probed from the first local record after a cooldown period.

- replay: Only local cache data is written to MTW; the real-time queue is not consumed. After the local cache is cleared, the system switches back to the live state.

- <targetData>.py: Real-time data ingestion script.

- get_create_table_script: Table creation script defining the schema of stream tables and DFS tables. The script is run when rebuilding the writer to prevent stream table invalidation caused by server shutdowns.

- create_message_handler: Core handler that processes each subscribed message, parses fields, and converts them into the write format before pushing them into the queue for the writer thread. For OHLC data, only closed bars are processed.

2.3.3 State Transition Details

live state (normal operation)

Real-time data is fetched from the queue and written directly to DolphinDB via MTW, with write results monitored.

State transition condition

MTW write fails: live → offline

if self.mode == 'live':

try:

row = realtime_q.get(timeout=LIVE_GET_TIMEOUT)

self._insert_one(row) # Call MTW for writing

except Exception as e:

# Processing sequence for write failure

save_unwritten_to_local() # 1. Save MTW's internal cache

self._append_rows_to_local([row]) # 2. Save rows failed to be written

self._save_queue_to_local() # 3. Save rows in the queue

writer = None # Mark MTW as invalid

self.mode = 'offline' # Switch to offline mode

self.next_probe_ts = time.time() + PROBE_COOLDOWN_SECS # Set the time for next probingoffline state (local cache mode)

To prevent data loss, the system automatically caches data locally during DolphinDB failures. After the cooldown period, it probes for recovery and automatically backfills cached data once the system is recovered.

State transition condition

Probing succeeds and the database connection is recovered: offline → replay

elif self.mode == 'offline':

now = time.time()

if now < self.next_probe_ts:

# Within cooldown period: only persist data locally

self._save_queue_to_local(max_n=50000) # Batch persistence to avoid blocking

time.sleep(0.1)

continue

# Cooldown period ended: attempt to probe livenessProbe mechanism: The system attempts a test write by reading and writing the first line of the local cache file. Success indicates that DolphinDB has recovered.

def _probe_from_local_first_line(self) -> bool:

# 1. Ensure an available MTW; rebuild it if missing

if writer is None and not build_mtw():

return False

# 2. Read and test the first line from the local file

with file_lock:

with open(self.path, "r", encoding="utf-8") as f:

line = f.readline()

if not line or not line.endswith("\n"):

return False

try:

row = json.loads(line)

self._insert_one(row) # Attempt to write a single record

return True # Success indicates recovery; then switch to live state

except Exception:

writer = None

return Falsereplay state (data backfill mode)

In this state, the real-time queue is not consumed to preserve historical data ordering. The system reads the local cache file in batches and writes data sequentially into the database. Large files are processed in batches to avoid memory overflow.

State transition conditions

- Local cache backfill completes successfully: replay → live

- Failure occurs during replay: replay → offline

def _replay_all_local(self) -> bool:

global writer

total = 0

try:

with file_lock:

src = open(self.path, "r", encoding="utf-8", newline="\n")

while True:

# Read in batches to avoid memory overflow

batch_lines = read_n_lines(READ_BATCH_SIZE)

if empty(batch_lines):

break

try:

# Batch write to the database

for line in batch_lines:

row = json.loads(line)

insert_one(row)

total += len(batch_lines)

except Exception as e:

# Roll back unwritten data and remaining records to local storage

return False

# All records written successfully, clear the local file

src.close()

with file_lock, open(self.path, "w", encoding="utf-8"):

pass

print(f"[{time.strftime('%H:%M:%S')}] Backfill completed, {total} rows written, cache cleared")

return True

except Exception as e:

print(f"[{time.strftime('%H:%M:%S')}] Backfill failed: {e} (cache retained, will retry)")

writer = None

return False2.3.4 Variables and Usage Instructions

Before running, ensure that the target database and tables exist in the DolphinDB server. Modify the following variables according to your requirements and execute the Python script. The full script is provided in the Appendix.

| Variable | Location | Description |

|---|---|---|

| DDB | config.py | DolphinDB connection settings: host, port, username, password |

| PROXY | config.py | Proxy address; does not apply to OKX real-time data |

| TIMEOUT | config.py | WebSocket timeout in seconds; default: 5s |

| PROBE_COOLDOWN_SECS | config.py | Probe interval; default: 30s |

| READ_BATCH_SIZE | config.py | Maximum number of lines read per batch during backfill; default: 20000 |

| LIVE_GET_TIMEOUT | config.py | Blocking wait time in seconds when fetching data from the real-time queue in live mode; default: 0.2s |

| RECONNECT_TIME | config.py | WebSocket reconnection wait time (effective for OKX real-time data) |

| OKX_WS_URL | config.py | WebSocket server address (effective for OKX real-time data) |

| dbName | Target data file (global config) | Target database name for subscription-based writes |

| tbName | Target data file (global config) | Target table name for subscription-based writes |

| streamtbName | Target data file (global config) | Stream table name |

| BUFFER_FILE | Target data file (global config) | Local cache file path |

| symbols | Target data file (global config) | Symbols to import (Binance format), e.g. ["btcusdt"] |

| inst_ids | Target data file (global config) | Symbols to import (OKX format), e.g. futures ["BTC-USDT-SWAP"], spot ["BTC-USDT"] |

| script | Function in target data file: get_create_table_script() | Table schema; For details, refer to Section 2.1. |

The following example describes how to ingest level 2 futures data using Binance_Future_KLine.py. You can modify the corresponding parameters to ingest other types of data.

- Create the required databases and tables for the target data types. We recommend that you do not change database or table names. For the full script, refer to createDatabase.dos provided in the Appendix.

- Create the required stream tables. To enable persistence, add the

following parameter to the node configuration

file:

persistenceDir=/home/DolphinDB/Data/Persistence - Install the required dependencies in the Python environment.

Example:

pip install dolphindb pip install binance-connector pip install binance-futures-connector pip install websockets pip install python-okx pip install okx - Modify config.py and the configuration class BinanceBaseConfig in

Binance_Future_KLine.py as needed.

Example:

// config.py -- modify DDB and PROXY as needed DDB={"HOST":'192.168.100.43',"PORT":8848,"USER":'admin',"PWD":'123456'} BINANCE_BASE_CONFIG={"PROXY":'http://127.0.0.1:7890/', "TIMEOUT":5, "PROBE_COOLDOWN_SECS":30, "READ_BATCH_SIZE":20000, "LIVE_GET_TIMEOUT":0.2 } //... // Binance_Future_KLine.py -- modify as needed class BinanceFutureKLineConfig(BinanceBaseConfig): """Binance minute-level data ingestion configuration""" tableName = "Cryptocurrency_minKLineST" BUFFER_FILE = "./Binance_fKLine_fail_buffer.jsonl" symbols = ["btcusdt","ethusdt","adausdt","algousdt", "bnbusdt","fetusdt","grtusdt","ltcusdt","xrpusdt"] - Create a WebSocket connection, subscribe to the target market data, and

keep the main thread

running.

// Subscription function must be configured def start_client_and_subscribe(self): // Create WebSocket connection client = UMFuturesWebsocketClient( on_message=self.create_message_handler(), proxies={'http': self.proxy_address, 'https': self.proxy_address} ) // Subscribe to target symbols for s in self.symbols: client.kline(symbol=s,interval="1m") time.sleep(0.2) return client # Usage if __name__ == "__main__": config = BinanceFutureKLineConfig() client = config.start_all() # Keep main thread alive try: while True: time.sleep(1) except KeyboardInterrupt: config.quick_exit()

To ingest real-time OHLC data at different frequencies, modify the subscription parameters (interval for Binance, channel for OKX ). For example, modify line 10 in the above code. Supported real-time OHLC frequencies are consistent with historical OHLC frequencies (see Section 2.2). For OKX, the real-time OHLC frequency requires the channel prefix, such as 'candle1m' and 'candle3m'; other frequencies follow the same pattern.

2.4 Monitoring and Daily Scheduled Backfill

Due to the complexity and uncertainty of cryptocurrency exchange networks, exception handling and monitoring are critical. Therefore, scheduled jobs are configured in DolphinDB for data integrity monitoring and daily batch processing, with alerts sent via communication channels such as WeCom, reducing the difficulty of data maintenance in quantitative trading systems.

2.4.1 Real-Time Data Monitoring

Core functions

- Stream table health checks: Monitor subscription status of stream tables (e.g., level 2 data, trade details, OHLC data) to prevent ingestion interruptions.

- Real-time data checks: Monitor whether new data arrives in each table within 30 minutes to detect issues in data sources.

- Alerting: Send real-time alerts via WeCom bots to ensure timely response.

2.4.2 Daily Data Processing

Core functions

- Data integrity checks: Verify the completeness of minute-level OHLC data for the previous trading day (e.g., number of symbols × 1440 minutes × 2 markets).

- Automatic backfill: If data is missing, batch-fetch data via RESTful APIs for both futures and spot markets.

- Batch factor computation: Compute MyTT technical metrics, Alpha factors, etc., based on complete data that has been cleansed.

- Retry policy: Retry up to 10 times to mitigate transient network issues; if still failing after retries, send alerts via WeCom bots.

2.4.3 Usage Instructions

This section describes how to configure the system based on actual needs. For the full scripts, refer to checkData.dos and getCleanKLineAfterDay.dos provided in the Appendix.

- Determine the WeCom group to receive alerts and create a bot to obtain the Webhook URL.

- Update the webhook variable in the scripts with the actual bot URL.

- Verify that the monitored/processed database and table names match the actual environment.

- Process daily data (getCleanKLineAfterDay.dos):

- Modify codes in

getBinanceCleanData(), as well as future_inst_ids and spot_inst_ids ingetOKXCleanData()based on selected assets. - To add more factors, update factor definitions in

outputNamesMap()and verify the target tables for factor storage.

- Modify codes in

- Use

scheduleJobto add scheduled tasks and adjust execution times as needed.

2.5 Funding Rate Data Ingestion

Funding rates are a key metric of perpetual futures market sentiment and price deviation. Their sign and magnitude directly reflect long-short balance, providing important quantitative signals for trend analysis. Based on the characteristics of funding rate data, scripts are provided to batch-import historical data and to periodically fetch the latest data via scheduled jobs in DolphinDB.

Historical Data

Both Binance and OKX provide historical funding rate data; however, OKX only provides data of the most recent three months. Below, we use Binance's historical funding rate data as an example. The full script is provided in the Appendix.

getBinanceFundingRate: Fetches data from the exchange and parses it into the database.def getBinanceFundingRate(param,proxy_address,dbName,tbName){ //... config[`proxy] = proxy_address response = httpClient::httpGet(baseUrl,param,10000,,config) result = parseExpr(response.text).eval() tb = each(def(mutable d){ d["symbol"] = string(d.symbol) //... return d },result).reorderColumns!(`symbol`symbolSource`fundingTime`fundingRate`markPrice) loadTable(dbName,tbName).tableInsert(tb) }getFundingRate: Retrieves historical data for specified symbols and time ranges, with reconnection on failure.def getFundingRate(codes,startDate,endDate,proxy_address,dbName,tbName){ //... for(code in codes){ do{ param = dict(STRING, ANY) param["symbol"] = code param["startTime"] = startTimeUTC param["endTime"] = endTimeUTC param["limit"] = 1000 // Import with retry on failure getBinanceFundingRate(param,proxy_address,dbName,tbName) cursor += long(8)*3600*1000*1000 sleep(200) }while(cursor < endTimeUTC) } }

You only need to set the cryptocurrency list, start time, and target database/table names.

codes = ["btcusdt","ethusdt","adausdt"].upper()

proxy_address = "http://127.0.0.1:7890"

dbName, tbName= ["dfs://CryptocurrencyDay",`fundingRate]

getFundingRate(codes,2023.01.01,2025.10.05,proxy_address,dbName,tbName)Real-time data

Since funding rates are updated every 8 hours, scheduled jobs are used to fetch them. Binance is used as an example below. The full script is provided in the Appendix.

getBinanceFundingRate: Calls the RESTful API to fetch funding rates, formats them into a vector usingparseExprandtranspose, and writes data to the target partitioned table.def getBinanceFundingRate(param,proxy_address,dbName,tbName){ //... config[`proxy] = proxy_address response = httpClient::httpGet(baseUrl,param,10000,,config) //... for(r in result){ r = select string(symbol),"Binance-Futures", timestamp(long(fundingTime)+8*3600*1000), double(fundingRate), double(markPrice) from r.transpose() loadTable(dbName,tbName).tableInsert(r) } }job_getFundingRate: Iterates over specified symbols and constructs the UTC start time. Requests are spaced by 200 ms to avoid rate limits. Modify the symbol list (codes) as needed (line 2). Alerts are sent on failure.def job_getFundingRate(webhook,proxy_address,dbName,tbName){ codes = ["btcusdt","ethusdt"].upper() // Use the timestamp from 2 minutes ago as the start time; schedule the job at :01 startTimeUTC = convertTZ(now()-2*60*1000, "Asia/Shanghai", "UTC") ts = long(timestamp(startTimeUTC)) for(code in codes){ param = dict(STRING, ANY) param["symbol"] = code param["startTime"] = ts getBinanceFundingRate(param) sleep(200) } if(errCnt == codes.size()){ msg = "Failed to fetch Binance fundingRate" sendWeChatMsg(msg,webhook) }

Configure scheduled jobs to fetch updated funding rates:

times = [08:01m, 16:01m, 00:01m]

proxy_address = 'http://127.0.0.1:7890'

dbName, tbName= ["dfs://CryptocurrencyDay",`fundingRate]

scheduleJob("fundingRateFetcher", "Fetch fundingRate",job_getFundingRate{proxy_address,dbName,tbName},times,

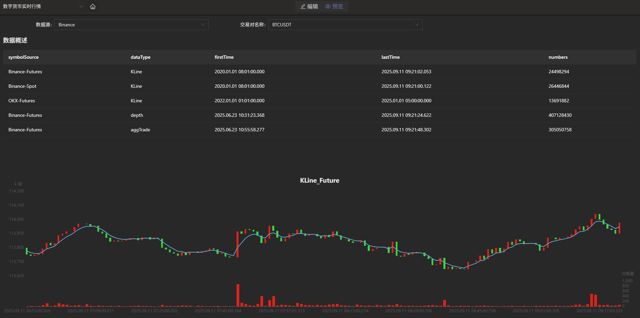

2025.06.17, 2035.12.31,"D")2.6 Market Data Visualization

After real-time market data ingestion, you can view live data in the DolphinDB data dashboard by importing the provided panel files. Dashboards support custom refresh intervals (e.g., 1 s). An example dashboard is shown below.

3. Unified Stream and Batch Processing for Factor Development

In quantitative trading, factor discovery is a critical step. Traditional approaches can be divided into manual discovery and algorithm-based discovery. Manual discovery relies heavily on researchers’ expertise and market insight, but it is inefficient, labor-intensive, and constrained by individual cognitive limits, making it difficult to fully capture the complex characteristics of the market. Algorithm-based discovery, on the other hand, leverages techniques such as machine learning to reduce manual costs. In particular, deep learning and neural networks, with their strong nonlinear fitting capabilities, can effectively capture complex nonlinear relationships among price-volume data, market sentiment, and macro or geopolitical factors in the cryptocurrency market, thereby generating factors that better reflect market fundamentals. Although deep learning models carry the risk of overfitting, this risk can be effectively controlled through proper model design, parameter tuning, and regularization, making them highly valuable for factor mining in cryptocurrency markets.

Training machine learning models for factor generation requires fast access to and processing of massive volumes of historical data. Traditional databases often suffer from low storage efficiency and slow query performance under such data scales. DolphinDB offers multiple advantages in quantitative factor discovery, significantly improving overall efficiency while aligning with practical requirements. Its built-in library of over 2,000 functions covering multiple domains and use cases provides fast and accurate data support for factor discovery, enabling machine learning models to be trained and optimized based on the latest market dynamics. In addition, DolphinDB’s streaming-batch framework allows you to efficiently perform batch factor computation while also supporting low-latency streaming computation, which can be applied in real time to cryptocurrency backtesting and simulated trading, closely approximating live trading conditions.

Accordingly, this chapter focuses on three aspects:

- How to design an optimal storage scheme for minute-level factor data based on DolphinDB;

- How to implement batch and streaming factor computation using DolphinDB’s built-in modules and plugins;

- How machine learning models are applied in backtesting and simulation.

3.1 Minute-Level Factor Database and Table Design

Given the characteristics of minute-level factor data and practical usage scenarios, we recommend using the TSDB storage engine and adopting a narrow-table schema with time and factor columns as partition keys. This design supports continuous growth in the number of factors while ensuring high write and query performance. The specific database and table design is as follows; the full script is provided in the Appendix.

| Database Name | Storage Engine | Partition Scheme | Partition Columns | Sort Columns | Partition Size |

|---|---|---|---|---|---|

| CryptocurrencyFactor | TSDB | Monthly partition + VALUE partition by factor name | Time + factor name | Market + asset + time | About 115.36 MB per single factor for 100 assets |

If the estimated number of combinations of market and asset exceeds 1,000, it

is recommended to reduce the dimension of the sort columns during database

creation by adding the following parameter:

sortKeyMappingFunction=[hashBucket{,3},

hashBucket{,300}].

The column definitions of the minute-level factor table (factor_1m) are as follows.

| Column Name | Data Type | Description |

|---|---|---|

| datetime | TIMESTAMP | Time column |

| symbol | SYMBOL | Asset for factor computation |

| market | SYMBOL | Market, such as ‘Binance-Futures’, ‘Binance-Spot’, ‘OKX-Futures’, ‘OKX-Spot’ |

| factorname | SYMBOL | Factor name |

| factorvalue | DOUBLE | Factor value |

3.2 Factor Computation

Taking DolphinDB’s built-in 191 Alpha and WorldQuant 101 Alpha factor libraries as examples, these factors were originally designed for the stock market. Therefore, cross-sectional and financial-statement-based factors are not applicable to the cryptocurrency market, and time-series factors are not defined as state functions. In this tutorial, applicable time-series factors are converted into state functions and stored in the stateFactors.dos file. You can load this module via use or modify it to develop custom factors. The full script is stateFactors.dos provided in the Appendix.

Using the gtjaAlpha100 factor as an example, we demonstrate how to perform both batch and streaming computation for the same factor in DolphinDB. In stateFactors.dos, gtjaAlpha100 is defined as:

@state

def gtjaAlpha100(vol){

return mstd(vol, 20)

}Compared with its definition in gtja191Alpha.dos, the only difference is the addition of @state, which converts it from a regular function into a state function, enabling direct use in streaming computation.

3.2.1 Batch Factor Computation

Factors are computed based on minute-level OHLC data, so historical minute-level OHLC data must exist in the DolphinDB server.

Batch computation consists of three steps: retrieving historical data, generating factor computation expressions, and computing and writing results to the database. The full script is provided in the Appendix.

- Retrieve historical data from the

database.

// Use the factor module use stateFactors go all_data = select * from loadTable("dfs://CryptocurrencyKLine","minKLine") factor_value_tb = loadTable("dfs://CryptocurrencyFactor", "factor_1min") - Generate factor computation

expressions.

cols_dict = { "vol": "volume" } def dict_replace_str(s, str_dict){ for (i in str_dict.keys()){ result = regexReplace(s, i, str_dict[i]) } return result } use_func_call = exec name.split("::")[1]+syntax from defs() where name ilike "%stateFactors%" funcName = func_call[:regexFind(func_call, "[()]+")] deal_func_call = dict_replace_str(func_call, cols_dict) select_string = stringFormat( "select eventTime,symbol,symbolSource,\"%W\" as factorname, %W as factorvalue from all_data context by symbol,symbolSource csort eventTime", funcName, deal_func_call)Here,

dict_replace_strandcols_dictare used to replace parameter names in function expressions. For example, the parameter vol corresponds to the column volume in the database, allowing you to compute factors without modifying original column names. - Loop through all factors and append results to the

database.

for (func_call in use_func_call){// func_call=use_func_call[0] funcName = func_call[:regexFind(func_call, "[()]+")] deal_func_call = dict_replace_str(func_call, cols_dict) select_string = stringFormat("select eventTime,symbol,symbolSource,\"%W\" as factorname, %W as factorvalue from all_data context by symbol,symbolSource csort eventTime", funcName, deal_func_call) result = select * from parseExpr(select_string).eval() factor_value_tb.append!(result) }

3.2.2 Streaming Factor Computation

Factors are computed based on minute-level OHLC data, so a minute-level OHLC stream table must exist.

Streaming factor computation includes three steps: creating a factor stream table, building a narrow reactive state engine, and subscribing to upstream data streams. The full script is provided in the Appendix.

- Create a persistent stream table to store computed factor

data.

// Stream table used to store factor data output_stream = "min_factor_stream" // Output table definition and conversion function try{dropStreamTable(output_stream)}catch(ex){} temp = streamTable(1:0, ["datetime","symbol","market","factorname","factorvalue"], ["TIMESTAMP","SYMBOL","SYMBOL","SYMBOL","DOUBLE"]) enableTableShareAndCachePurge(temp, output_stream, 10000000) def output_handler(msg, output_stream){ if (count(msg) == 0){return} cols = msg.columnNames()[2 0 1 3 4] tb = objByName(output_stream) tb.append!(<select _$$cols from msg>.eval()) } //Used as a placeholder for output table in the engine with no actual effect. try{dropStreamTable("output_tmp")}catch(ex){} share streamTable(1:0, ["symbol","market","datetime","factorname","factorvalue"], ["SYMBOL","SYMBOL","TIMESTAMP","SYMBOL","DOUBLE"]) as output_tmpBefore building the reactive state engine that returns a table in narrow format, the output table and output handler must be created. The above code defines

output_handlerand two stream tables (output_stream and output_tmp). Theoutput_handlerfunction will serve as the outputHandler parameter for the engine. After setting this parameter, the results will no longer be written to the output table, but instead, output_handler will process the results. Therefore, the actual result writing happens at line 12 of the code. output_tmp is used as a placeholder, and after the engine is created, this stream table can be deleted. - Build the narrow reactive state

engine.

// List of required factor function names func_table = select * from defs() where name ilike "%stateFactors%" factor_fuc_name = func_table["name"].split("::")[1] // List of factor metric computation meta-code factor = [<eventTime>] factor_fuc_syntax = parseExpr(func_table["name"] + func_table["syntax"]) factor.appendTuple!(factor_fuc_syntax) engine_name = "cryto_cal_min_factor_stream" // Try to drop the existing stream engine, if any try { dropStreamEngine(engine_name) } catch (ex) {} // Create the narrow reactive state engine engine = createNarrowReactiveStateEngine( name=engine_name, keyColumn=["symbol", "symbolSource"], // Grouping columns metrics=factor, // Factor computation meta-code metricNames=factor_fuc_name, // Factor name dummyTable=table(1:0, ["eventTime", "collectionTime", "symbolSource", "symbol", "open", "high", "low", "close", "vol", "numberOfTrades", "quoteVolume", "takerBuyBase", "takerBuyQuote", "volCcy"], ["TIMESTAMP", "TIMESTAMP", "SYMBOL", "SYMBOL", "DOUBLE", "DOUBLE", "DOUBLE", "DOUBLE", "DOUBLE", "INT", "DOUBLE", "DOUBLE", "DOUBLE", "DOUBLE"]), outputHandler=output_handler{, output_stream}, outputTable=objByName("output_tmp"), msgAsTable=true ) try { dropStreamTable("output_tmp") } catch (ex) {}To add custom factors, you only need to append factor names and computation logic to

factor_fuc_nameandfactor. - Subscribe to upstream data streams.

For example, subscribe to Cryptocurrency_minKLineST, the minute-level OHLC stream table.

input_stream = 'Cryptocurrency_minKLineST' try{unsubscribeTable(,input_stream, "cal_min_factors")}catch(ex){} subscribeTable(,input_stream, "cal_min_factors", getPersistenceMeta(objByName(input_stream))["memoryOffset"], engine, msgAsTable=true, throttle=1, batchSize=10)

3.3 Model Training and Real-Time Signal Generation

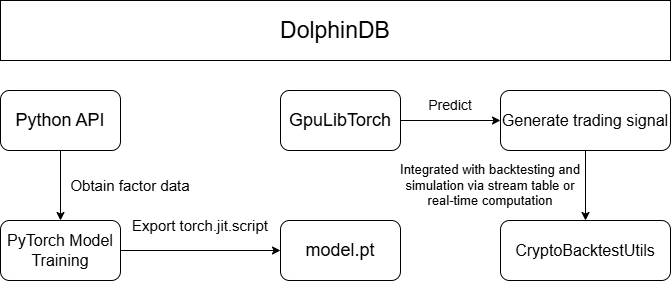

After factor computation and storage, machine learning models are trained and applied to backtesting and simulation for generating trading signals. The workflow consists of four steps:

- factor data retrieval and preprocessing;

- factor model training in Python;

- factor model export;

- trading signal prediction within DolphinDB combined with the backtesting and simulation framework. The fourth step supports both historical and real-time signal generation. The overall workflow is illustrated in Figure 3-1.

3.3.1 Data Retrieval and Preprocessing

Historically computed factor data is stored in dfs://CryptocurrencyFactor,

currently containing only 1-minute factors, with more frequencies to be

added in the future. To simplify factor data retrieval and standardization

in a Python client via the DolphinDB API, preprocessing is encapsulated in

the Python class FactorDataloader. All preprocessing is

executed on the DolphinDB server, and the Python client only receives the

processed data.

FactorDataloader provides preprocessing support for LSTM,

XGBoost, and Transformer models. Example:

from DataPre import FactorDataloader

ddb_connect = ddb.session("ip", port)

t = FactorDataloader(

db_connect=ddb_connect,

symbol="BTCUSDT",

start_date="2024.03.01",

end_date="2024.03.02",

factor_name=["gtjaAlpha2"],

market="Binance-Futures",

)

train_loader, test_loader = t.get_LSTM_dataloader(10, 0.2, 32)

train_loader, test_loader = t.get_xgboost_data(0.2)

train_loader, test_loader = t.get_transformer_data(1440, 0.2, 32)3.3.2 Python Model Training

The DolphinDB’s GpuLibTorch plugin allows you to load and run the TorchScript model exported from Python, combining DolphinDB’s data processing capabilities with PyTorch’s deep learning functionality. You can run the following functions to install and load the GpuLibTorch plugin.

login("admin", "123456")

listRemotePlugins()

installPlugin("GpuLibTorch")

loadPlugin("GpuLibTorch")The plugin does not support training models within DolphinDB, so training must be performed in a Python environment. A generic training and evaluation framework for three-class classification tasks is implemented in Models.py, supporting LSTM and Transformer models. The related functions are as follows:

# Functions

evaluate_classify_model(model, test_loader, device=torch.device("cuda" if torch.cuda.is_available() else "cpu"))

train_model(

model,

criterion,

optimizer,

num_epochs: int,

train_loader,

test_loader,

device=torch.device("cuda" if torch.cuda.is_available() else "cpu"),

per_epoch_show: int = 20,

)

# Usage

# Model training

criterion = nn.CrossEntropyLoss()

optimizer = optim.Adam(model.parameters(), lr=0.001, weight_decay=1e-5)

trained_model = train_model(

model=model,

criterion=criterion,

optimizer=optimizer,

num_epochs=100,

train_loader=train_loader,

test_loader=test_loader,

)

# Model evaluation

accuracy, preds, targets = evaluate_classify_model(trained_model, test_loader)3.3.3 Model Export

After training in Python, the model needs to be exported as a model.pth file for prediction in DolphinDB. Models exported using torch.jit.trace may cause an error when loading in DolphinDB due to hidden layer tensors and input tensors not being on the same device. Therefore, we recommend that you use torch.jit.script to export the model file.

torch.jit.script(model).save("model.pth")3.3.4 Model Prediction and Backtesting/Simulation

Historical Computation Method

After obtaining the model, predictions can be made on upstream factor data using the GpuLibtorch plugin to generate trading signals for backtesting. This method requires pre-computed future signals and is suitable for backtesting only. For real-time simulation, the real-time computation method discussed later should be used.

table_name = "factor_predict_result"

try{

undef(table_name, SHARED)

print(table_name+" exists, stream table cleared")

} catch(ex) {

print(table_name+" does not exist, environment cleaned")

}

share(table(100000: 0, `datetime`signal, [TIMESTAMP, INT]), table_name)

model = GpuLibTorch::load(model_file)

predict_result = GpuLibTorch::predict(model, data_input)The above code creates a stream table named factor_predict_result to store the pre-computed signals for easy retrieval during backtesting. As shown in lines 9-10, you can load the trained model using GpuLibTorch and input pre-processed data (data_input) to get the model output (predict_result). The results are then inserted into the factor_predict_result stream table. The preprocessing of data_input is detailed in the DataPre.py script provided in the Appendix.

After obtaining the trading signal stream table factor_predict_result, it can be used in the event callback function for backtesting. The following example generates trading signals for BTCUSDT from 2025.03.01 to 2025.05.01 using an LSTM model, as shown in line 3. The callback function performs buy and sell operations based on the signal, as shown in lines 11 and 17. The full script is in the Appendix.

def onBar(mutable context, msg, indicator){

//...

singal_t = objByName("factor_predict_result")

for(isymbol in msg.keys()){

source = msg[isymbol]["symbolSource"]

lastPrice = msg[isymbol]["close"]

tdt = msg[isymbol]["tradeTime"]

signal = exec signal from singal_t where datetime=tdt

signal = signal[0]

if (signal==int(NULL)){break}

if (signal==0){

// Sell

qty = Backtest::getPosition(context["engine"], isymbol, "futures").longPosition

if (qty > 0){

Backtest::submitOrder(context["engine"], (isymbol, source, context["tradeTime"], 0, lastPrice, 0, 1000000, qty, 3, 0, 0, context["tradeTime"].temporalAdd(1m)), "sell", 0, "futures")

}

} else if (signal==2){

// Buy

Backtest::submitOrder(context["engine"], (isymbol, source, context["tradeTime"], 5, lastPrice, 0, 1000000, 0.001, 1, 0, 0, context["tradeTime"].temporalAdd(1m)), "buy", 0, "futures")

}

}

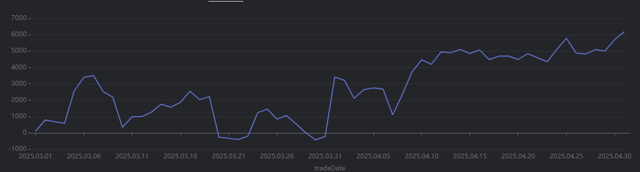

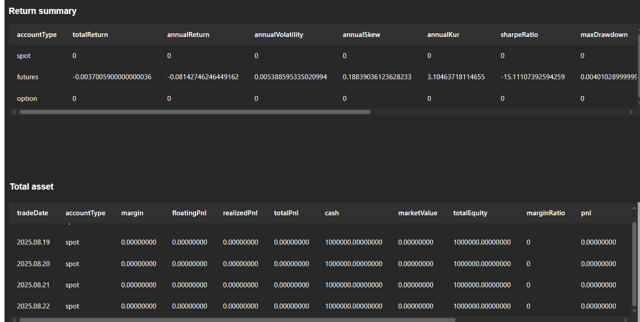

}After the backtest is completed, the daily realized profit and loss curve can be plotted as shown in Figure 3-2:

result = select * from day where accountType="futures"

plot((double(result["realizedPnl"])), result["tradeDate"])

Real-time computation method

In addition to pre-computing trading signals for backtesting based on historical data, you can also simulate real-time trading by computing real-time factors and generating trading signals using a pre-trained model. This method is suitable for both historical market backtesting and simulated trading.

Below is the core code for a minute-level backtest demo that uses the gtjaAlpha94 and gtjaAlpha50 alpha factors for prediction. Since the factor computation functions in the built-in factor library of DolphinDB are not state functions, you need to use the factor computation functions that have been converted to state functions in the stateFactors module (see the previous section for module description).

- Pre-load the required model using a shared

dictionary.

// Initialize the model through a shared dictionary model_dir = "/home/customer/model_config/test_LSTM.pth" model = GpuLibTorch::load(model_dir) GpuLibTorch::setDevice(model, "CUDA") try{undef("test_ml_model", SHARED)}catch(ex){} test_ml_model = syncDict(STRING, ANY, "test_ml_model") go; test_ml_model["model"] = modelThis avoids reloading the model during subsequent computation. After loading the model, the GpuLibTorch::setDevice function must be called to specify the computing device for prediction. Otherwise, the default CPU will be used.

- Subscribe to signals in the

initializefunction to compute metrics.def gen_signal(factor1, factor2){ model = objByName("test_ml_model")["model"] data_input = matrix(zscore(factor1).nullFill!(0), zscore(factor2)).nullFill!(0).float() data_input = tensor(array(ANY).append!(data_input)) x = GpuLibTorch::predict(model, data_input)[0] signal = imax(1/(1+exp(x*-1))) return signal } def initialize(mutable context){ print("initialize load model") // Metric subscription indicator_dict = dict(STRING, ANY) indicator_dict["signal"] = <moving(gen_signal, (gtjaAlpha94(close.double(), volume.double()), gtjaAlpha50(high.double(), low.double())), 20)> Backtest::subscribeIndicator(context["engine"], "kline", indicator_dict, "futures") }By defining the meta-code in the initialize function, the backtesting engine can compute factor data in real time during backtesting and simulation. The corresponding model can be called in the signal computation function to generate signals. The event callback functions then obtain the trading signals through the indicator parameter. Here’s a usage example for the onBar callback function:

def onBar(mutable context, msg, indicator){ //... one_msg = msg[isymbol] one_indicator = indicator[isymbol] signal = one_indicator["signal"] tdt = one_msg["tradeTime"] if (signal == int(NULL)){continue} if (signal == 0){ // Sell qty = Backtest::getPosition(context["engine"], isymbol, "futures").longPosition if (qty > 0){ Backtest::submitOrder(context["engine"], (isymbol, source, context["tradeTime"], 0, lastPrice, 0, 1000000, qty, 3, 0, 0, context["tradeTime"].temporalAdd(1m)), "sell", 0, "futures") } }else if (signal == 2){ // Buy Backtest::submitOrder(context["engine"], (isymbol, source, context["tradeTime"], 5, lastPrice, 0, 1000000, 0.001, 1, 0, 0, context["tradeTime"].temporalAdd(1m)), "buy", 0, "futures") } }

In the above onBar callback function, you can obtain the

real-time computed results of the signal generation function, which are

subscribed to in the initialize function, through the indicator

parameter, and then open or close positions based on the corresponding

signals. The full script is provided in the Appendix.

4. Strategy Backtesting and Simulated Trading

Before deploying a quantitative strategy to live trading, extensive backtesting and simulated trading are required to validate its effectiveness and feasibility. Mid- to high-frequency strategy backtesting and simulation for cryptocurrency trading face two major challenges. First, massive data storage and processing, especially for high-frequency snapshot data, which places extremely high demands on framework-level data processing and computational performance. Second, complex matching logic, where order execution must consider order price, traded volume, and market volatility, rather than simply using the latest price.

Leveraging its high-performance distributed architecture and low-latency streaming engine, DolphinDB integrates a backtesting engine with an order matching simulator to deliver an end-to-end backtesting and simulated trading solution. This solution supports market data replay and processing, strategy development and code management, result visualization, and strategy permission management. It supports both snapshot and minute-level cryptocurrency data, enabling individuals and quantitative teams to efficiently develop strategies with low code volume and a low learning curve. In addition to native DLang, strategies can also be written in Python and C++, offering high performance, low cost, and strong extensibility.

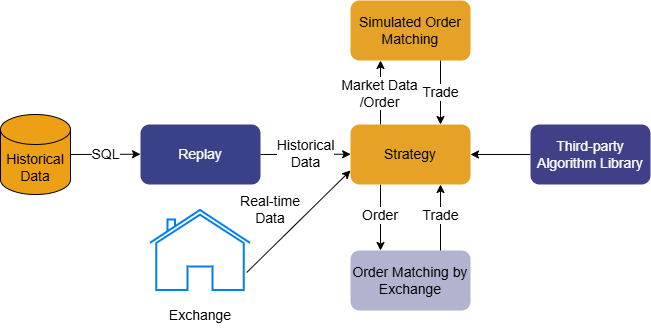

4.1 Cryptocurrency Backtesting Engine

In DolphinDB, backtesting consists of four components: user-defined strategy functions, strategy configuration and creation, market data replay, and execution of the backtesting engine to obtain results. The cryptocurrency backtesting engine is provided as a plugin, and its logical architecture is shown in Figure 4-1. The main workflow includes:

- The engine replays market data streams in chronological order and dispatches them to the order matching simulator and market data callback functions.

- Market data callback functions process strategy logic and submit orders.

- The engine performs risk control management.

- Orders that pass risk control are sent to the order matching simulator for execution.

- The engine tracks positions and funds in real time, and returns strategy returns and trade details after backtesting completes.

The backtesting engine supports both snapshot and minute-level cryptocurrency data, and allows a single engine to manage multiple spot and futures accounts as well as different contract types. Cryptocurrency methods support specifying account operations via the accountType parameter.

When using DolphinDB for cryptocurrency strategy backtesting, the market data passed into the engine must strictly conform to the required data schema, often requiring substantial data cleansing and transformation. However, since strategy researchers prioritize designing and optimizing strategy logic, i.e., writing market callback functions, this solution streamlines the entire workflow. It not only provides raw exchange data, but also delivers processed and replay-ready snapshot and minute-level market data. Therefore, you can focus only on custom strategy functions and strategy configuration to quickly complete backtesting.

4.2 Strategy Development and Code Management

Market data access, backtest execution functions, trade simulation functions, and

code management for cryptocurrency backtesting are encapsulated in the

CryptocurrencySolution module. Based on the cryptocurrency

data environment built in Chapter 2, you can directly use this module to perform strategy

backtesting. The sub-modules are described below:

| Sub-module | Catagory | Description |

|---|---|---|

CryptocurrencySolution::utils |

Common functions | Includes common functions such as engine deletion and management, funding rate retrieval, base information tables, OHLC data downsampling, backtest and simulation strategy retrieval, strategy log retrieval, and database/stream table status checks. |

CryptocurrencySolution::setting |

Unified settings | Includes unified strategy configuration, GitLab address configuration, module lists, and database/table metadata. |

CryptocurrencySolution::runBacktest |

Backtesting | Includes market data retrieval and processing functions, and backtest execution functions. |

CryptocurrencySolution::simulatedTrading |

Simulation | Includes market data retrieval and processing functions, and simulation start/stop function. |

CryptocurrencySolution::manageScripts |

Code storage | Includes strategy upload, retrieval, and deletion functions, backtest result storage and retrieval functions, and backtest/simulation code submission and storage function. |

First, obtain the home directory using getHomeDir(), place the attached module folder in the corresponding path, and load it using use:

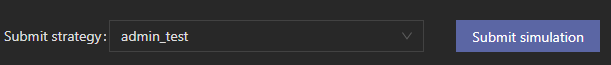

use CryptocurrencySolution::manageScripts

goTo meet strategy storage and management requirements, this solution integrates with GitLab. When submitting a strategy for backtesting or simulation, the system automatically uploads the strategy code to a specified Git repository, enabling unified management, version tracking, and rapid retrieval. For details, see Section 4.4.

If strategy code storage is not required, you can use the following modules for backtesting or simulation only:

// Backtesting

use CryptocurrencySolution::runBacktest

go

// Simulation

use CryptocurrencySolution::simulatedTrading

go4.2.1 Writing Cryptocurrency Strategies

In this section, we introduce how to write cryptocurrency strategies. More detailed examples are provided in Chapter 5.

User-defined event callback functions

The backtesting engine adopts an event-driven mechanism and provides the following event functions. You can customize callbacks for strategy initialization, daily pre-market processing, snapshot and OHLC market data, and order and trade reports.

| Event Function | Description |

|---|---|

initialize(mutable context) |

Strategy initialization function: triggered once. The parameter context represents the logical context. In this function, you can use context to initialize global variables or subscribe to metric computation. |

beforeTrading(mutable context) |

Callback executed during the daily session rollover; triggered once when the trading day switches. |

onSnapshot(mutable context, msg) |

Snapshot market data callback. |

onBar(mutable context, msg) |

Low- to mid-frequency market data callback. |

onOrder(mutable context, orders) |

Order report callback, triggered whenever an order’s status changes. |

onTrade(mutable context, trades) |

Trade execution callback, triggered when a trade occurs. |

finalize(mutable context) |

Triggered once before strategy termination. |

- If GitLab-based strategy code management is required, the strategy must be declared using module, and the module name must match strategyName.

- Required modules used in callbacks must be listed in getUsedModuleName() in CryptocurrencySolution::setting. Otherwise, strategy code will fail to be uploaded.

module testMinStrategy //Declare the strategy module when enabling code management

def initialize(mutable context){

}

def beforeTrading(mutable context){

}

def onBar(mutable context,msg, indicator){

}

def onSnapshot( mutable context,msg, indicator){

}

def onOrder( mutable context,orders){

}

def onTrade(mutable context,trades){

}

def finalize (mutable context){

}

strategyName = "testMinStrategy"4.2.2 Cryptocurrency Strategy Configuration

The userConfig strategy configuration must include the strategy type,

backtest start and end dates, market data type, initial capital, and the

cryptocurrency asset to be backtested. The

CryptocurrencySolution::setting module provides default

strategy configuration, which can be obtained using the following

function:

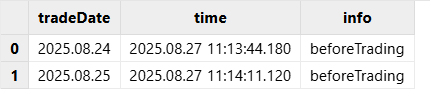

startDate = 2025.08.24

endDate = 2025.08.25

dataType = 3 // Minute-level market data; set to 1 for snapshot data

userConfig = CryptocurrencySolution::setting::getUnifiedConfig(startDate, endDate, dataType)An example of the userConfig is shown below:

sym = ["BTCUSDT"]

userConfig = dict(STRING,ANY)

userConfig["startDate"] = 2025.08.24

userConfig["endDate"] = 2025.08.25

userConfig["strategyGroup"] = "cryptocurrency"

cash = dict(STRING,DOUBLE)

cash["spot"] = 1000000.

cash["futures"] = 1000000.

cash["option"] = 1000000.

userConfig["cash"] = cash

userConfig["dataType"] = 3 // 1: snapshot; 3: minute-level

userConfig["Universe"] = sym // Symbol for backtesting (required)

p = dict(STRING,ANY)

p["Universe"] = userConfig["Universe"] + "_futures"

p["log"] = table(10000:0,[`tradeDate,`time,`info],[DATE,TIMESTAMP,STRING]) // log table for debugging

userConfig["context"] = p // Pass the asset universeTo backtest historical market data, you can customize the start and end dates in userConfig. This module automatically loads the default strategy configuration and allows user-provided userConfig values to override the defaults. By default, Binance data is used, and the backtest period is the most recent 10 days.

userConfig = dict(STRING,ANY)

userConfig["startDate"] = 2025.08.24

userConfig["endDate"] = 2025.08.25

// Example: backtest an asset (used to define the asset universe)

p = dict(STRING,ANY)

p["Universe"] = ["XRPUSDT_futures"]

userConfig["context"] = p

strategyType = 0

engine, straname_ =

CryptocurrencySolution::manageScripts::runCryptoAndUploadToGit(

strategyName, eventCallbacks, strategyType, userConfig

)To downsample OHLC data, you can use the built-in downsampling function and specify the barMinutes parameter:

strategyType = 0

engine, straname_ =

CryptocurrencySolution::manageScripts::runCryptoAndUploadToGit(

strategyName, eventCallbacks, strategyType, , barMinutes = 1

)To use market data from the OKX exchange, specify exchange =

"OKX". Otherwise, it defaults to "Binance":

engine, straname_ =

CryptocurrencySolution::manageScripts::runCryptoAndUploadToGit(

strategyName, eventCallbacks, strategyType, exchange = "OKX"

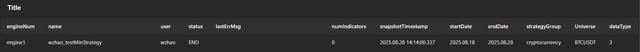

)4.2.3 Strategy Backtest Execution and Result Retrieval

After setting the strategyName, eventCallbacks, and

strategyType parameters, call

runCryptoAndUploadToGit to execute the backtest.

strategyName = "testMinStrategy"

eventCallbacks = {

"initialize": initialize,

"beforeTrading": beforeTrading,

"onBar": onBar,

"onOrder": onOrder,

"onTrade": onTrade,

"finalize": finalize

}

// Execute backtest and upload strategy files to GitLab

strategyType = 0

engine, straname_ =

CryptocurrencySolution::manageScripts::runCryptoAndUploadToGit(

strategyName, eventCallbacks, strategyType

)- During backtest execution, the strategy files are automatically uploaded to the specified GitLab repository, and the corresponding commit ID is stored in the gitstrategy table of the database dfs://CryptocurrencyStrategy.

- If strategy code management is not required, you can use

runCryptoBacktestfrom theCryptocurrencySolution::runBacktestmodule. This function automatically loads default strategy configuration and allows you to override it with a custom userConfig. By default, it performs backtesting on Binance data for the most recent 10 days.

// userConfig = dict(STRING,ANY)

// userConfig["startDate"] = 2025.11.10

// userConfig["endDate"] = 2025.11.20

engine, straname_ =

CryptocurrencySolution::runBacktest::runCryptoBacktest(

strategyName, eventCallbacks, userConfig

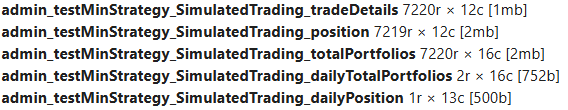

)Retrieve backtest results