Window Calculations

Window calculations are frequently used in analyzing time series data. DolphinDB provides window functions that can process both tables and matrices. In addition, window functions in DolphinDB can also be used in stream processing.

DolphinDB's window functions are flexible, which can be nested with multiple built-in or user-defined functions. With optimized functions, DolphinDB has an outstanding performance for window calculations.

This tutorial helps you quickly get started with the powerful window functions in DolphinDB.

Note: Version 1.30.7/2.00.0 or higher supports most of the scripts in this tutorial (see details in the specific sections), and all scripts are supported in version 1.30.15/2.00.3 or higher.

1. Windows

DolphinDB supports five types of windows: tumbling window, sliding window (moving window), cumulative window, session window, and segment window.

Windows can be count-based or time-based regarding how window size is measured. Window size refers to the number of records in each window or how long each window lasts.

For functions related to sliding windows and cumulative windows, another parameter step is provided. It indicates how much each window moves forward relative to the previous one.

The next sections are going to explain each of them in detail.

1.1. Tumbling Windows

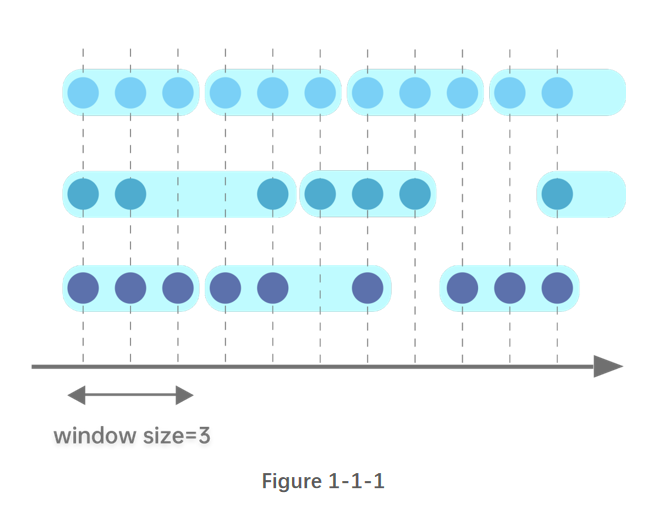

Tumbling windows have a fixed size and do not overlap. Each record belongs to exactly one window.

count-based tumbling window:

The following figure illustrates a tumbling window of size 3. Each window has the same number of records, but the time interval of each window might be different.

time-based tumbling window:

The following figure illustrates a tumbling window of size 3. Each window has the same time interval, but the number of records in each window might be different.

1.2. Sliding Windows

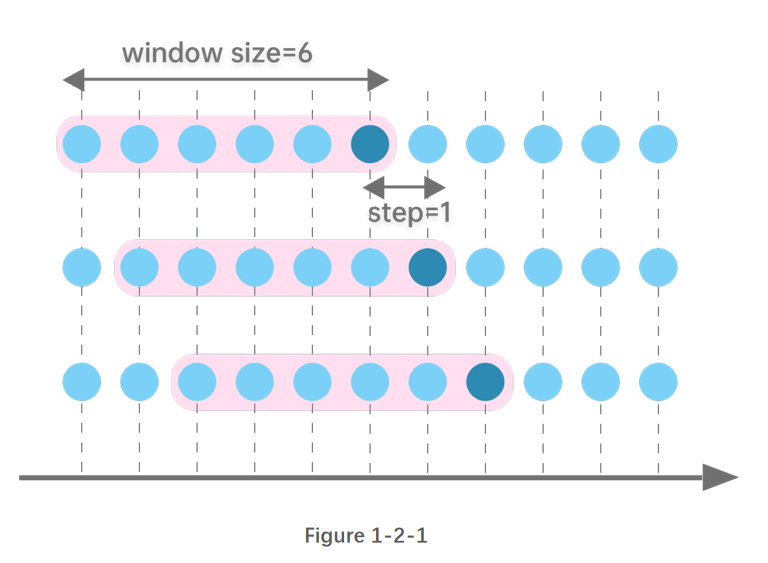

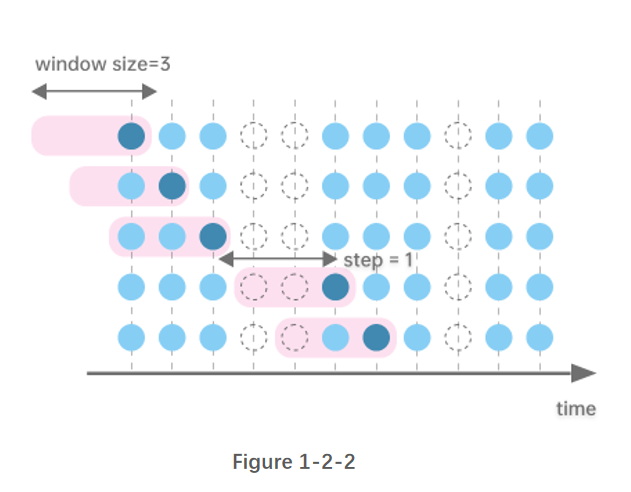

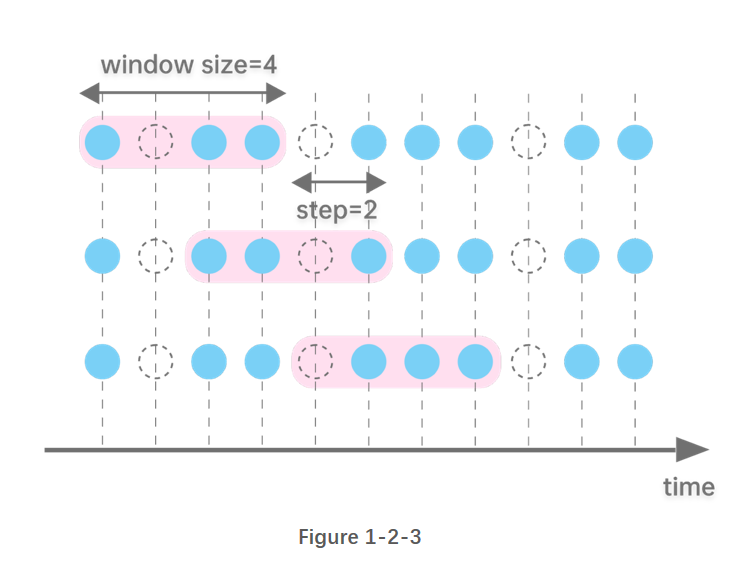

Sliding windows have fixed length and move with specified steps. Different from tumbling windows, sliding windows can be overlapping if the step is smaller than the window size. Note that a tumbling window is simply a sliding window whose 'step' is equal to its 'window size'.

count-based sliding window:

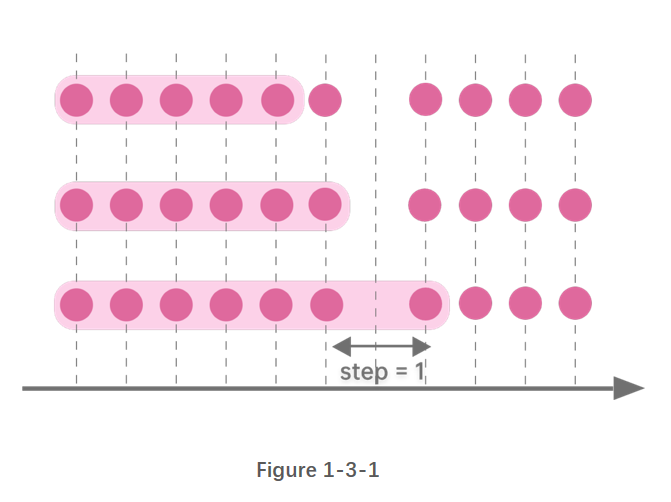

Supposing step=1, the following figure illustrates a sliding window of size 6.

time-based sliding window:

step=1, the following figure illustrates a sliding window of size 3.

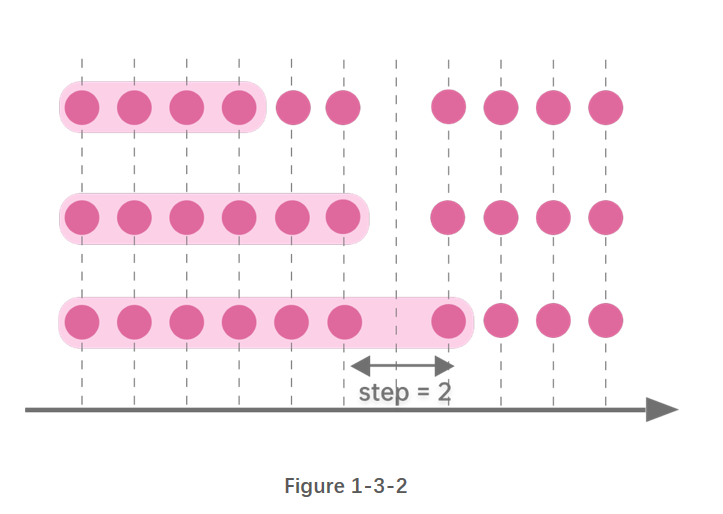

If step is specified as time interval, it must be divisile by window size. The following figure illustrates a sliding window of size 4, and step 2.

1.3. Cumulative Windows

The left boundary of cumulative windows is fixed and the right boundary keeps moving right. The window size keeps increasing.

You can get cumulative windows with specified step:

step=1

As shown in Figure 1-3-1, the window size accumulates as the right boundary keeps moving right by 1 row each time.

step=t time units

As shown in Figure 1-3-2, the window size accumulates as right boundary keeps moving right by 2 time units.

1.4. Session Windows

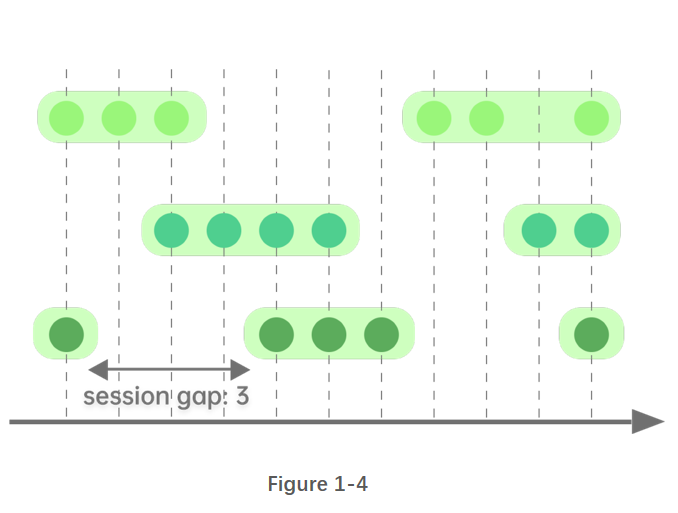

Session windows are a special type of windows with variable length. Two session windows are separated by a period of specified length with no data. If there is no data for a specified length of time after an observation, it is marked as the end of a session window and the next observation is the start of the next session window.

As shown in Figure 1-4, two session windows are separated by a session gap that is greater than 3 time units with no data.

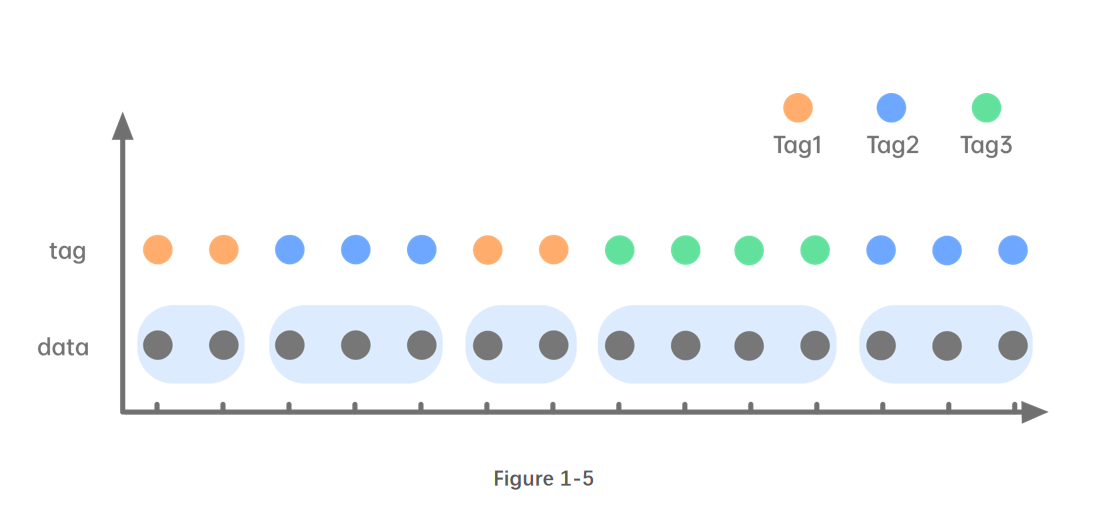

1.5. Segment Windows

Consecutive identical elements are grouped into one segment window. Segment windows have a variable length.

2. Process Tables with Windows (using SQL)

This chapter gives specific examples on how to conduct window calculations in DolphinDB with SQL statements: tumbling windows, sliding windows, cumulative windows, segment windows, and window join.

2.1. Tumbling Windows

2.1.1. Time-based tumbling windows

You can use functions such as interval, bar, and dailyAlignedBar, together with group by clause for aggregations over time-based tumbling windows.

The following example is based on the records updated every second from 10:00:00 to 10:05:59. With function bar, the sum of the trading volume is calculated every 2 minutes:

t=table(2021.11.01T10:00:00..2021.11.01T10:05:59 as time, 1..360 as volume)

select sum(volume) from t group by bar(time, 2m)# output

bar_time sum_volume

------------------- ----------

2021.11.01T10:00:00 7260

2021.11.01T10:02:00 21660

2021.11.01T10:04:00 36060 The windows grouped by the bar function takes the timestamp that is divisible by parameter interval as the start time. It can not be used for scenarios where the start time is specified (and cannot be divided by interval).

Some tradings also occur beyond regular trading hours. Some futures markets have overnight trading sessions. For these cases, use function dailyAlignedBar and specify the starting time and ending time of the trading sessions.

In the following example, there are two trading sessions: from 1:30 pm to 3:00 pm and 9:00 pm to 2:30 am the next day. Function dailyAlignedBar is used to calculate 7-minute average prices for each session.

sessions = 13:30:00 21:00:00

ts = 2021.11.01T13:30:00..2021.11.01T15:00:00 join 2021.11.01T21:00:00..2021.11.02T02:30:00

ts = ts join (ts+60*60*24)

t = table(ts, rand(10.0, size(ts)) as price)

select avg(price) as price, count(*) as count from t group by dailyAlignedBar(ts, sessions, 7m) as k7

# output

k7 price count

------------------- ----------------- -----

2021.11.01T13:30:00 4.815287529108381 420

2021.11.01T13:37:00 5.265409774828835 420

2021.11.01T13:44:00 4.984934388122167 420

...

2021.11.01T14:47:00 5.031795592230213 420

2021.11.01T14:54:00 5.201864532018313 361

2021.11.01T21:00:00 4.945093814017518 420

//Using the bar function may not get the expected results.

select avg(price) as price, count(*) as count from t group by bar(ts, 7m) as k7

# output

k7 price count

------------------- ----------------- -----

2021.11.01T13:26:00 5.220721067537347 180 //the starting time is 13:26:00, not the expected 13:30:00

2021.11.01T13:33:00 4.836406542137931 420

2021.11.01T13:40:00 5.100716347573325 420

2021.11.01T13:47:00 5.041169475132067 420

2021.11.01T13:54:00 4.853431270784876 420

2021.11.01T14:01:00 4.826169502311608 420 There are some inactive futures without any offers for a period of time. The results, however, need to be output every 2 seconds for analysis. In this case, function interval can be used for interpolation.

In the following example, we specify the parameter fill as prev, i.e., the missing values are filled with the previous result. If there are identical values in one window, the last one is returned.

t=table(2021.01.01T01:00:00+(1..5 join 9..11) as time, take(`CLF1,8) as contract, 50..57 as price)

select last(contract) as contract, last(price) as price from t group by interval(time, 2s,"prev")

# output

interval_time contract price

------------------- -------- -----

2021.01.01T01:00:00 CLF1 50

2021.01.01T01:00:02 CLF1 52

2021.01.01T01:00:04 CLF1 54

2021.01.01T01:00:06 CLF1 54

2021.01.01T01:00:08 CLF1 55

2021.01.01T01:00:10 CLF1 57

//Using the bar function may not get the expected results.

select last(contract) as contract, last(price) as price from t group by bar(time, 2s)

bar_time contract price

------------------- -------- -----

2021.01.01T01:00:00 CLF1 50

2021.01.01T01:00:02 CLF1 52

2021.01.01T01:00:04 CLF1 54

2021.01.01T01:00:08 CLF1 55

2021.01.01T01:00:10 CLF1 57 2.1.2. Count-based tumbling windows

As market participation is skewed toward the beginning and end of the trading day, a majority of the trades are concentrated in the first and last hours of the trading day. Time-based window metrics may be based on vastly different amounts of trades. For certain considerations we may want to use count-based windows.

The following example calculates the sum of volume per 100 trades in the last minute of the stock market on a given day.

t=table(2021.01.05T02:59:00.000+(1..2000)*30 as time, take(`CL,2000) as sym, 10* rand(50, 2000) as vol)

select rolling(last,time,100,100) as last_time,rolling(last,t.sym,100,100) as sym, rolling(sum,vol,100,100) as vol_100_sum from t

# output (Results are different because of the rand function)

last_time sym vol_100_sum

----------------------- --- -----------

2021.01.05T02:59:03.000 CL 24,900

2021.01.05T02:59:06.000 CL 24,390

2021.01.05T02:59:09.000 CL 24,340

2021.01.05T02:59:12.000 CL 24,110

2021.01.05T02:59:15.000 CL 23,550

2021.01.05T02:59:18.000 CL 25,530

2021.01.05T02:59:21.000 CL 26,700

2021.01.05T02:59:24.000 CL 26,790

2021.01.05T02:59:27.000 CL 27,090

2021.01.05T02:59:30.000 CL 25,610

2021.01.05T02:59:33.000 CL 23,710

2021.01.05T02:59:36.000 CL 23,920

2021.01.05T02:59:39.000 CL 23,000

2021.01.05T02:59:42.000 CL 24,490

2021.01.05T02:59:45.000 CL 23,810

2021.01.05T02:59:48.000 CL 22,230

2021.01.05T02:59:51.000 CL 25,380

2021.01.05T02:59:54.000 CL 25,830

2021.01.05T02:59:57.000 CL 24,020

2021.01.05T03:00:00.000 CL 25,150 2.2. Sliding Windows

Processing tables with sliding windows has the following four scenarios:

2.2.1. step=1, window size=n

In this case, the m-functions, moving function, rolling function, and window function (supported in V1.30.16/2.00.4 or higher) can be used.

Compared with the moving function, the window function uses a more flexible window whose both right and left boundary can be specified.

In the following example, the msum function is used to calculate the sum of volume with a sliding window of size 5.

t=table(2021.11.01T10:00:00 + 0 1 2 5 6 9 10 17 18 30 as time, 1..10 as vol)

select time, vol, msum(vol,5,1) from t

# output

time vol msum_vol

------------------- --- --------

2021.11.01T10:00:00 1 1

2021.11.01T10:00:01 2 3

2021.11.01T10:00:02 3 6

2021.11.01T10:00:05 4 10

2021.11.01T10:00:06 5 15

...As a unique feature in DolphinDB, context by is an extension to the ANSI SQL statements. The context by clause makes it convenient to perform calculations within groups.

t=table(2021.11.01T10:00:00 + 0 1 2 5 6 9 10 17 18 30 join 0 1 2 5 6 9 10 17 18 30 as time, 1..20 as vol, take(`A,10) join take(`B,10) as sym)

select time, sym, vol, msum(vol,5,1) from t context by sym

# output

time sym vol msum_vol

------------------- --- --- --------

2021.11.01T10:00:00 A 1 1

2021.11.01T10:00:01 A 2 3

2021.11.01T10:00:02 A 3 6

...

2021.11.01T10:00:30 A 10 40

2021.11.01T10:00:00 B 11 11

2021.11.01T10:00:01 B 12 23

...

2021.11.01T10:00:30 B 20 90 The m-functions are optimized for their specialized use cases. You can call user-defined aggregate functions in the moving function, window function, and rolling function.

The following market data has four columns (code, date, close, and volume). It is grouped by code, and sorted by date within the group. The average close of the five largest volume is calculated with a sliding window of size 20.

t = table(take(`IBM, 100) as code, 2020.01.01 + 1..100 as date, rand(100,100) + 20 as volume, rand(10,100) + 100.0 as close)

//The result can be obtained with a single line of code in version 1.30.15 or later.

//moving supports user-defined anonymous aggregate functions(https://www.dolphindb.com/help/Functionalprogramming/AnonymousFunction.html).

select code, date, moving(defg(vol, close){return close[isort(vol, false).subarray(0:min(5,close.size()))].avg()}, (volume, close), 20) from t context by code

//Use user-defined named aggregate functions.

defg top_5_close(vol,close){

return close[isort(vol, false).subarray(0:min(5,close.size()))].avg()

}

select code, date, moving(top_5_close,(volume, close), 20) from t context by code When calculating Alpha 98 defined in 101 Formulaic Alphas, DolphinDB can use only a few lines of code to simplify the process with nested window functions. Compared with the C# script with hundreds of lines, DolphinDB is faster up to three orders of magnitude.

You can use the sample data CNTRADE.

// The schema of the input table trade is as follows. You can simulate the data yourself.

name typeString typeInt

---------- ---------- -------

ts_code SYMBOL 17

trade_date DATE 6

open DOUBLE 16

vol DOUBLE 16

amount DOUBLE 16

// calculate alpha 98:

def normRank(x){

return rank(x)\x.size()

}

def alpha98SQL(t){

update t set adv5 = mavg(vol, 5), adv15 = mavg(vol, 15) context by ts_code

update t set rank_open = normRank(open), rank_adv15 = normRank(adv15) context by trade_date

update t set decay7 = mavg(mcorr(vwap, msum(adv5, 26), 5), 1..7), decay8 = mavg(mrank(9 - mimin(mcorr(rank_open, rank_adv15, 21), 9), true, 7), 1..8) context by ts_code

return select ts_code, trade_date, normRank(decay7)-normRank(decay8) as a98 from t context by trade_date

}

input = select trade_date,ts_code,amount*1000/(vol*100 + 1) as vwap,vol,open from trade

timer alpha98DDBSql = alpha98SQL(input)2.2.2. step=1, window size=t time units

You can use tm-functions or tmoving function to conduct window calculations in this case.

The twindow function is available since version 1.30.16/2.00.4. Compared with the tmoving function, the twindow function uses a more flexible window whose both right and left boundary can be specified.

The following example uses the tmsum function to calculate the sum of volume with a 5-second sliding window.

//Function tmsum is supported since version 1.30.14/2.00.2

t=table(2021.11.01T10:00:00 + 0 1 2 5 6 9 10 17 18 30 as time, 1..10 as vol)

select time, vol, tmsum(time,vol,5s) from t

# output

time vol tmsum_time

------------------- --- ----------

2021.11.01T10:00:00 1 1

2021.11.01T10:00:01 2 3

2021.11.01T10:00:02 3 6

2021.11.01T10:00:05 4 9

2021.11.01T10:00:06 5 12

2021.11.01T10:00:09 6 15

2021.11.01T10:00:10 7 18

2021.11.01T10:00:17 8 8

2021.11.01T10:00:18 9 17

2021.11.01T10:00:30 10 10 The above calculation is also widely used in the quantile-based historical stock analysis (refer to section "step=1, window size=n" for details).

2.2.3. step=n, window size=m

You can find function rolling helpful in this case.

Unlike the interval function, rolling function does not fill missing values. Thus, the window with missing elements is not output.

The following example calculates the sum of the volume with sliding windows (step=3, and window size=6). The last window with only 4 records is not printed.

t=table(2021.11.01T10:00:00+0 3 5 6 7 8 15 18 20 29 as time, 1..10 as vol)

select rolling(last,time,6,3) as last_time, rolling(sum,vol,6,3) as sum_vol from t

# output

last_time sum_vol

------------------- -------

2021.11.01T10:00:08 21

2021.11.01T10:00:20 392.2.4. step=t time units, window size=n*t time units

In such case, you can use the interval function (V1.30.14/2.00.2 or higher recommended) together with the group by clause.

The following example calculates the sum of volume with sliding windows (step=5 seconds, and window size=10 seconds).

t=table(2021.11.01T10:00:00+0 3 5 6 7 8 15 18 20 29 as time, 1..10 as vol)

select sum(vol) from t group by interval(time, 10s, "null", 5s)

# output

interval_time sum_vol

------------------- -------

2021.11.01T10:00:00 21

2021.11.01T10:00:05 18

2021.11.01T10:00:10 15

2021.11.01T10:00:15 24

2021.11.01T10:00:20 19

2021.11.01T10:00:25 10 The example using the interval function for the tumbling window can be regarded as a special case of sliding window where step=window size. The instance here, however, shows a sliding window with a window size of n times the step.

2.3. Cumulative Windows

For cumulative windows, calculations are either based on the count-based window or time-based window.

2.3.1. step=1

Thecum-functions can be used for such case.

The following example uses the cumsum function to get cumulative sum of volume.

t=table(2021.11.01T10:00:00..2021.11.01T10:00:04 join 2021.11.01T10:00:06..2021.11.01T10:00:10 as time,1..10 as vol)

select *, cumsum(vol) from t

# output

time vol cum_vol

------------------- --- -------

2021.11.01T10:00:00 1 1

2021.11.01T10:00:01 2 3

2021.11.01T10:00:02 3 6

2021.11.01T10:00:03 4 10

2021.11.01T10:00:04 5 15

2021.11.01T10:00:06 6 21

2021.11.01T10:00:07 7 28

2021.11.01T10:00:08 8 36

2021.11.01T10:00:09 9 45

2021.11.01T10:00:10 10 55 context by can be used with cum-functions for cumulative calculations within groups.

The following example calculates the cumulative trading volume of each stock.

t=table(2021.11.01T10:00:00 + 0 1 2 5 6 9 10 17 18 30 join 0 1 2 5 6 9 10 17 18 30 as time, 1..20 as vol, take(`A,10) join take(`B,10) as sym)

select*, cumsum(vol) as cumsum_vol from t context by sym

# output

time vol sym cumsum_vol

------------------- --- --- ----------

2021.11.01T10:00:00 1 A 1

2021.11.01T10:00:01 2 A 3

...

2021.11.01T10:00:18 9 A 45

2021.11.01T10:00:30 10 A 55

2021.11.01T10:00:00 11 B 11

2021.11.01T10:00:01 12 B 23

...

2021.11.01T10:00:18 19 B 135

2021.11.01T10:00:30 20 B 155 2.3.2. step=t time units

Function bar, together with cgroup by, can be used to calculate time-based cumulative windows.

t=table(2021.11.01T10:00:00..2021.11.01T10:00:04 join 2021.11.01T10:00:06..2021.11.01T10:00:10 as time,1..10 as vol)

select sum(vol) from t cgroup by bar(time, 5s) as time order by time

# output

time sum_vol

------------------- -------

2021.11.01T10:00:00 15

2021.11.01T10:00:05 45

2021.11.01T10:00:10 55 2.4. Segment Windows

The window sizes of the above windows are all fixed. Function segment supported in DolphinDB creates windows with consecutive identical elements, which is often used for processing tick data.

Windows in the following example are segmented by order_type. The cumulative turnover for consecutive identical order_type is calculated.

vol = 0.1 0.2 0.1 0.2 0.1 0.2 0.1 0.2 0.1 0.2 0.1 0.2

order_type = 0 0 1 1 1 2 2 1 1 3 3 2;

t = table(vol,order_type);

select *, cumsum(vol) as cumsum_vol from t context by segment(order_type);

# output

vol order_type cumsum_vol

--- ---------- ----------

0.1 0 0.1

0.2 0 0.3

0.1 1 0.1

0.2 1 0.3

0.1 1 0.4

0.2 2 0.2

0.1 2 0.3

0.2 1 0.2

0.1 1 0.3

0.2 3 0.2

0.1 3 0.3

0.2 2 0.2 2.5. Window Join in SQL

DolphinDB supports window join (the combination of table join and window calculations). It can be implemented with the wj and pwj functions.

The calculation is conducted on the right table with time-based windows that are determined by the timestamp of each record in the left table. Each record in the left table is joined with the corresponding result in the right table.

It can be seen as a flexible sliding window, because both the left and right boundary can be specified (negative numbers are supported).

Refer to window join for details.

//data

t1 = table(1 1 2 as sym, 09:56:06 09:56:07 09:56:06 as time, 10.6 10.7 20.6 as price)

t2 = table(take(1,10) join take(2,10) as sym, take(09:56:00+1..10,20) as time, (10+(1..10)\10-0.05) join (20+(1..10)\10-0.05) as bid, (10+(1..10)\10+0.05) join (20+(1..10)\10+0.05) as offer, take(100 300 800 200 600, 20) as volume);

//window join

wj(t1, t2, -5s:0s, <avg(bid)>, `sym`time);

# output

sym time price avg_bid

--- -------- ----- -------

1 09:56:06 10.6 10.3

1 09:56:07 10.7 10.4

2 09:56:06 20.6 20.3 Window join can be conducted on two different tables as well as one table.

The following example calculates the average bid with the window from (time-6s) to (time+1s) for each record in t2.

t2 = table(take(1,10) join take(2,10) as sym, take(09:56:00+1..10,20) as time, (10+(1..10)\10-0.05) join (20+(1..10)\10-0.05) as bid, (10+(1..10)\10+0.05) join (20+(1..10)\10+0.05) as offer, take(100 300 800 200 600, 20) as volume);

wj(t2, t2, -6s:1s, <avg(bid)>, `sym`time);

# output

sym time bid offer volume avg_bid

--- -------- ---- ------ ------ --------

1 09:56:01 10.05 10.15 100 10.1

...

1 09:56:08 10.75 10.85 800 10.5

1 09:56:09 10.85 10.95 200 10.6

1 09:56:10 10.95 11.05 600 10.65

2 09:56:01 20.05 20.15 100 20.1

2 09:56:02 20.15 20.25 300 20.15

...

2 09:56:08 20.75 20.85 800 20.5

2 09:56:09 20.85 20.9 200 20.6

2 09:56:10 20.95 21.05 600 20.65Starting from version 1.30.16/2.00.4, the window and twindow functions can also be used to conduct window calculations within a single table.

t2 = table(take(1,10) join take(2,10) as sym, take(09:56:00+1..10,20) as time, (10+(1..10)\10-0.05) join (20+(1..10)\10-0.05) as bid, (10+(1..10)\10+0.05) join (20+(1..10)\10+0.05) as offer, take(100 300 800 200 600, 20) as volume);

//twindow

select *, twindow(avg,t2.bid,t2.time,-6s:1s) from t2 context by sym

//window

select *, window(avg, t2.time.indexedSeries(t2.bid), -6s:1s) from t2 context by sym

# output

sym time bid offer volume avg_bid

--- -------- ---- ------ ------ --------

1 09:56:01 10.05 10.15 100 10.1

...

1 09:56:08 10.75 10.85 800 10.5

1 09:56:09 10.85 10.95 200 10.6

1 09:56:10 10.95 11.05 600 10.65

2 09:56:01 20.05 20.15 100 20.1

2 09:56:02 20.15 20.25 300 20.15

...

2 09:56:08 20.75 20.85 800 20.5

2 09:56:09 20.85 20.9 200 20.6

2 09:56:10 203. Process Matrices with Windows

As calculations for tables have been discussed above, this chapter will focus on how to process matrices with windows.

3.1. Process Matrices with Sliding Windows

You can use m-functions and window function to perform calculations within each column of the matrix, and return a matrix with the same shape as the input matrix.

If the window slides by time, use the setIndexedMatrix! function to set the row and column labels of the matrix as indices. It should be noted that labels must be monotonically increasing.

Create a matrix and set it as an indexed matrix:

m=matrix(1..4 join 6, 11..13 join 8..9)

m.rename!(2020.01.01..2020.01.04 join 2020.01.06,`A`B)

m.setIndexedMatrix!();3.1.1. step=1, window size=n

Parameter window of m-functions can be a positive integer (count-based) or a DURATION type (time-based).

The following example use function msum to calculate the sum with sliding windows of size 3.

msum(m,3,1)

# output

A B

-- --

2020.01.01|1 11

2020.01.02|3 23

2020.01.03|6 36

2020.01.04|9 33

2020.01.06|13 30Calculations on matrices can also be implemented with nested window functions. With a few lines of codes, you can use a matrix to calculate Alpha 98 mentioned in section "Sliding Windows".

You can use the sample data CNTRADE.

// The schema of the input table trade is as follows. You can simulate the data yourself.

name typeString typeInt

---------- ---------- -------

ts_code SYMBOL 17

trade_date DATE 6

open DOUBLE 16

vol DOUBLE 16

amount DOUBLE 16

// calculate alpha 98:

def prepareDataForDDBPanel(){

t = select trade_date,ts_code,amount*1000/(vol*100 + 1) as vwap,vol,open from trade

return dict(`vwap`open`vol, panel(t.trade_date, t.ts_code, [t.vwap, t.open, t.vol]))

}

def myrank(x) {

return rowRank(x)\x.columns()

}

def alpha98Panel(vwap, open, vol){

return myrank(mavg(mcorr(vwap, msum(mavg(vol, 5), 26), 5), 1..7)) - myrank(mavg(mrank(9 - mimin(mcorr(myrank(open), myrank(mavg(vol, 15)), 21), 9), true, 7), 1..8))

}

input = prepareDataForDDBPanel()

alpha98DDBPanel = alpha98Panel(input.vwap, input.open, input.vol)3.1.2. step=1, window size=t time units

Take function msum for example, calculate the sum with sliding windows of 3 days.

msum(m,3d)

# output

A B

-- --

2020.01.01|1 11

2020.01.02|3 23

2020.01.03|6 36

2020.01.04|9 33

2020.01.06|10 17It's common to calculate matrices with windows in practice. When analyzing quantile-based historical stock, you can get the result with a single line of code after converting the data to an indexed matrix.

In the following example, 10-year records in matrix m are ranked in quantiles:

//It is recommended to use mrank function with version 1.30.4, 2.00.2 or later.

mrank(m, true, 10y, percent=true)

# output

A B

- ----

2020.01.01|1 1

2020.01.02|1 1

2020.01.03|1 1

2020.01.04|1 0.25

2020.01.06|1 0.4 3.2. Process Matrices with Cumulative Windows

The cum-functions can also be used for processing matrices.

Take function cumsum for example, the cumulative sum of each column is calculated.

cumsum(m)

# output

A B

-- --

2020.01.01|1 11

2020.01.02|3 23

2020.01.03|6 36

2020.01.04|10 44

2020.01.06|16 534. Stream Processing with Windows

There are various built-in streaming engines for stream processing in DolphinDB. These engines can be used in different scenarios, which support calculations with aggregate functions, sliding or cumulative windows, and session windows.

4.1. Tumbling Windows in Streaming

Tumbling windows are widely used to process streaming data, such as 5-minute OHLC bars, and 1-minute cumulative volume, etc. The following time-series engines can be used:

- time-series engine (createTimeSeriesEngine)

- daily time-series engine (createDailyTimeSeriesEngine)

- session window engine (createSessionWindowEngine)

Function createDailyTimeSeriesEngine is similar to dailyAlignedBar, which calculates with specified sessions instead of the time-based windows for incoming data.

Take function createTimeSeriesEngine for example, the time-series engine "timeSeries1" subscribes to the stream table "trades". Calculate the sum of volume within one minute for each stock of table trades in real time.

share streamTable(1000:0, `time`sym`volume, [TIMESTAMP, SYMBOL, INT]) as trades

output1 = table(10000:0, `time`sym`sumVolume, [TIMESTAMP, SYMBOL, INT])

timeSeries1 = createTimeSeriesEngine(name="timeSeries1", windowSize=60000, step=60000, metrics=<[sum(volume)]>, dummyTable=trades, outputTable=output1, timeColumn=`time, useSystemTime=false, keyColumn=`sym, garbageSize=50, useWindowStartTime=false)

subscribeTable(tableName="trades", actionName="timeSeries1", offset=0, handler=append!{timeSeries1}, msgAsTable=true);

insert into trades values(2018.10.08T01:01:01.785,`A,10)

insert into trades values(2018.10.08T01:01:02.125,`B,26)

insert into trades values(2018.10.08T01:01:10.263,`B,14)

insert into trades values(2018.10.08T01:01:12.457,`A,28)

insert into trades values(2018.10.08T01:02:10.789,`A,15)

insert into trades values(2018.10.08T01:02:12.005,`B,9)

insert into trades values(2018.10.08T01:02:30.021,`A,10)

insert into trades values(2018.10.08T01:04:02.236,`A,29)

insert into trades values(2018.10.08T01:04:04.412,`B,32)

insert into trades values(2018.10.08T01:04:05.152,`B,23)

sleep(10)

select * from output1;

# output

time sym sumVolume

----------------------- --- ---------

2018.10.08T01:02:00.000 A 38

2018.10.08T01:02:00.000 B 40

2018.10.08T01:03:00.000 A 25

2018.10.08T01:03:00.000 B 9

//to drop the time series engine

dropStreamEngine(`timeSeries1)

unsubscribeTable(tableName="trades", actionName="timeSeries1")

undef("trades",SHARED)4.2. Sliding Windows and Cumulative Windows in Streaming

Another commonly used engine is the reactive state engine (created by createReactiveStateEngine), which supports optimized state functions, including cum-functions, m-functions, and tm-functions.

It is a powerful function that can process stream data using SQL-like mechanisms, achieving unified stream and batch processing.

The following example shows how cum-functions, m-functions, and tm-functions work in the reactive state engine.

//Function tmsum is supported in version 1.30.4, 2.00.2 or later.

share streamTable(1000:0, `time`sym`volume, [TIMESTAMP, SYMBOL, INT]) as trades

output2 = table(10000:0, `sym`time`Volume`msumVolume`cumsumVolume`tmsumVolume, [ SYMBOL,TIMESTAMP,INT, INT,INT,INT])

reactiveState1= createReactiveStateEngine(name="reactiveState1", metrics=[<time>,<Volume>,<msum(volume,2,1)>,<cumsum(volume)>,<tmsum(time,volume,2m)>], dummyTable=trades, outputTable=output2, keyColumn="sym")

subscribeTable(tableName="trades", actionName="reactiveState1", offset=0, handler=append!{reactiveState1}, msgAsTable=true);

insert into trades values(2018.10.08T01:01:01.785,`A,10)

insert into trades values(2018.10.08T01:01:02.125,`B,26)

insert into trades values(2018.10.08T01:01:10.263,`B,14)

insert into trades values(2018.10.08T01:01:12.457,`A,28)

insert into trades values(2018.10.08T01:02:10.789,`A,15)

insert into trades values(2018.10.08T01:02:12.005,`B,9)

insert into trades values(2018.10.08T01:02:30.021,`A,10)

insert into trades values(2018.10.08T01:04:02.236,`A,29)

insert into trades values(2018.10.08T01:04:04.412,`B,32)

insert into trades values(2018.10.08T01:04:05.152,`B,23)

sleep(10)

select * from output2

# output

sym time Volume msumVolume cumsumVolume tmsumVolume

--- ----------------------- ------ ---------- ------------ -----------

A 2018.10.08T01:01:01.785 10 10 10 10

B 2018.10.08T01:01:02.125 26 26 26 26

A 2018.10.08T01:01:12.457 28 38 38 38

B 2018.10.08T01:01:10.263 14 40 40 40

A 2018.10.08T01:02:10.789 15 43 53 53

B 2018.10.08T01:02:12.005 9 23 49 49

A 2018.10.08T01:02:30.021 10 25 63 63

A 2018.10.08T01:04:02.236 29 39 92 54

B 2018.10.08T01:04:04.412 32 41 81 41

B 2018.10.08T01:04:05.152 23 55 104 64

//to drop the reactive state engine

dropAggregator(`reactiveState1)

unsubscribeTable(tableName="trades", actionName="reactiveState1")

undef("trades",SHARED)4.3. Session Window Engine

createSessionWindowEngine can group elements by sessions of activity, i.e., the window ends if there is no incoming data in a specified interval. Therefore, the windows of session window engine are generated at unfixed frequencies with a variable size.

For example:

share streamTable(1000:0, `time`volume, [TIMESTAMP, INT]) as trades

output1 = keyedTable(`time,10000:0, `time`sumVolume, [TIMESTAMP, INT])

engine_sw = createSessionWindowEngine(name = "engine_sw", sessionGap = 5, metrics = <sum(volume)>, dummyTable = trades, outputTable = output1, timeColumn = `time)

subscribeTable(tableName="trades", actionName="append_engine_sw", offset=0, handler=append!{engine_sw}, msgAsTable=true)

n = 5

timev = 2018.10.12T10:01:00.000 + (1..n)

volumev = (1..n)%1000

insert into trades values(timev, volumev)

n = 5

timev = 2018.10.12T10:01:00.010 + (1..n)

volumev = (1..n)%1000

insert into trades values(timev, volumev)

n = 3

timev = 2018.10.12T10:01:00.020 + (1..n)

volumev = (1..n)%1000

timev.append!(2018.10.12T10:01:00.027 + (1..n))

volumev.append!((1..n)%1000)

insert into trades values(timev, volumev)

select * from trades;

//the incoming data is as follows:

time volume

----------------------- ------

2018.10.12T10:01:00.001 1

2018.10.12T10:01:00.002 2

2018.10.12T10:01:00.003 3

2018.10.12T10:01:00.004 4

2018.10.12T10:01:00.005 5

2018.10.12T10:01:00.011 1

2018.10.12T10:01:00.012 2

2018.10.12T10:01:00.013 3

2018.10.12T10:01:00.014 4

2018.10.12T10:01:00.015 5

2018.10.12T10:01:00.021 1

2018.10.12T10:01:00.022 2

2018.10.12T10:01:00.023 3

2018.10.12T10:01:00.028 1

2018.10.12T10:01:00.029 2

2018.10.12T10:01:00.030 3

//the result after calculating with session windows of size 5(ms)

select * from output1

time sumVolume

----------------------- ---------

2018.10.12T10:01:00.001 15

2018.10.12T10:01:00.011 15

2018.10.12T10:01:00.021 6

// to drop SessionWindowEngine

unsubscribeTable(tableName="trades", actionName="append_engine_sw")

dropAggregator(`engine_sw)

undef("trades",SHARED)5. Null Values Handling

In DolphinDB, there are differences in dealing with null values for window functions.

5.1. moving, m-functions, tm-functions, and cum-functions

Similar to aggregate functions, the m-functions, cum-functions, and tm-functions (excluding mrank, cumrank, and tmrank) ignore null values in calculations.

For mrank, cumrank, and tmrank, you can specify whether null values are included in the ranking.

The moving function and m-functions (excluding mrank) provide the minPeriods parameter for specifying the minimum number of observations in a window.

Specifically,

- If minPeriods is not specified, return NULL for the first (window-1) windows.

- If minPeriods is specified, return NULL for the first (minPeriods-1) windows.

- If all values in a window are null, return NULL for this window.

The default value of minPeriods is the value of window.

For example:

m=matrix(1..5, 6 7 8 NULL 10)

//If minPeriod is not specified, minPeriod=window. Thus, the first two rows of the result are null.

msum(m,3)

#0 #1

-- --

6 21

9 15

12 18

//If minPeriods=1, the first two rows of the result are not null.

msum(m,3,1)

#0 #1

-- --

1 6

3 13

6 21

9 15

12 185.2. rolling Function

Different from the moving function, the rolling function does not return null values of the first (window -1) elements.

For example, t is a table containing null values. Calculate sums with windows of size 3.

vol=1 2 3 4 NULL NULL NULL 6 7 8

t= table(vol)

//Use rolling function to calculate the sum with a window of size 3.

rolling(sum,t.vol,3)

# output

[6,9,7,4,,6,13,21]

//Use moving function to calculate the sum with a window of size 3.

moving(sum,t.vol,3)

# output

[,,6,9,7,4,,6,13,21]

//Use rolling function to calculate the sum with a window of size 3 and step 2.

rolling(sum,t.vol,3,2)

# output

[6,7,,13] //The last window without enough elements is not returned.6. Computational Complexity

If there are n elements, and the window size is m, then the time complexity of the commonly used m-functions and tm-functions is O(n), i.e., each calculation simply removes the element at position 0, and add a new observation.

Different from other functions, the runtime of mrank function is slower. Its time complexity is O(mn), which is positively related to its window size.

The complexity of these higher-order functions such as moving, tmoving, rolling, window, twindow is related to the func parameter. Therefore, the func function is applied to the entire window each time the window slides, which is different from the incremental calculation of the m-functions and tm-functions.

Therefore, compared with these higher-order functions, m-functions and tm-functions have better performance for the same calculation.

For example:

n=1000000

x=norm(0,1, n);

//moving

timer moving(avg, x, 10);

// Time elapsed: 243.331 ms

//rolling

timer rolling(avg, x, 10);

// Time elapsed: 599.389ms

//mavg

timer mavg(x, 10);

// Time elapsed: 3.501ms7. Functions Related to Windows

| Aggregate Function | m-functions | whether it is supported by reactive state engine | tm-functions | whether it is supported by reactive state engine | cum-functions | whether it is supported by reactive state engine |

|---|---|---|---|---|---|---|

| moving (higher-order function) | √ | tmoving (higher-order function) | √ | |||

| window (higher-order function) | supported by window join engine | twindow (higher-order function) | supported by window join engine | |||

| avg | mavg | √ | tmavg | √ | cumavg | √ |

| sum | msum | √ | tmsum | √ | cumsum | √ |

| beta | mbeta | √ | tmbeta | √ | cumbeta | √ |

| corr | mcorr | √ | tmcorr | √ | cumcorr | √ |

| count | mcount | √ | tmcount | √ | cumcount | √ |

| covar | mcovar | √ | tmcovar | √ | cumcovar | √ |

| imax | mimax | √ | ||||

| imin | mimin | √ | ||||

| max | mmax | √ | tmmax | √ | cummax | √ |

| min | mmin | √ | tmmin | √ | cummin | √ |

| first | mfirst | √ | tmfirst | √ | ||

| last | mlast | √ | tmlast | √ | ||

| med | mmed | √ | tmmed | √ | cummed | |

| prod | mprod | √ | tmprod | √ | cumprod | √ |

| var | mvar | √ | tmvar | √ | cumvar | √ |

| varp | mvarp | √ | tmvarp | √ | cumvarp | √ |

| std | mstd | √ | tmstd | √ | cumstd | √ |

| stdp | mstdp | √ | tmstdp | √ | cumstdp | √ |

| skew | mskew | √ | tmskew | √ | ||

| kurtosis | mkurtosis | √ | tmkurtosis | √ | ||

| percentile | mpercentile | √ | tmpercentile | √ | cumpercentile | |

| rank | mrank | √ | tmrank | √ | cumrank | |

| wsum | mwsum | √ | tmwsum | √ | cumwsum | √ |

| wavg | mwavg | √ | tmwavg | √ | cumwavg | √ |

| ifirstNot | mifirstNot | |||||

| ilastNot | milastNot | |||||

| firstNot | cumfirstNot | √ | ||||

| lastNot | cumlastNot | √ | ||||

| mad | mmad | √ | ||||

| move | √ | tmove | √ | |||

| mslr | √ | |||||

| ema | √ | |||||

| kama | √ | |||||

| sma | √ | |||||

| wma | √ | |||||

| dema | √ | |||||

| tema | √ | |||||

| trima | √ | |||||

| t3 | √ | |||||

| ma | √ | |||||

| wilder | √ | |||||

| gema | √ | |||||

| linearTimeTrend | √ | |||||

| mse | mmse | |||||

| cumPositiveStreak |

Other functions related to windows:

Note: deltas, ratios, interval, bar, dailyAlignedBar, coevent, createReactiveStateEngine, createDailyTimeSeriesEngine, createReactiveStateEngine, createSessionWindowEngine

8. Conclusion

The window functions can easily implement various complex logics, making data analysis more concise and efficient.