portfolioPricer

语法

portfolioPricer(instrument, amount, pricingDate,

marketData)

详情

对一个或多个金融合约(可为相同类型或不同类型)进行组合定价。

参数

instrument INSTRUMENT 类型对象,表示需要定价的金融工具。可以是单个合约,也可以是多个合约。

amount INT 类型标量或向量,与 instrument 等长,表示对应的合约数量。

pricingDate DATE 类型标量,表示定价日,即计算合约价值所对应的日期。

marketData MKTDATA 类型向量/嵌套字典/ 市场数据引擎句柄/用户自定义函数,表示市场数据。

-

MKTDATA 类型向量:

-

若为曲线类市场数据,需指定 curveName 字段。

-

若为曲面类市场数据,需指定 surfaceName 字段。

-

-

嵌套字典的结构如下:

-

第一层:key 为数据类别,可选值:"Spot", "Curve", "Surface"。

-

第二层:key 为定价日期(DATE 类型标量)。

-

第三层:key 为曲线或曲面名称,value 为对应的 MKTDATA 类型标量。

-

-

自定义函数:参数为 (kind,date,name)。

返回值

DOUBLE 类型标量。

instrument 和 marketData 的匹配规则

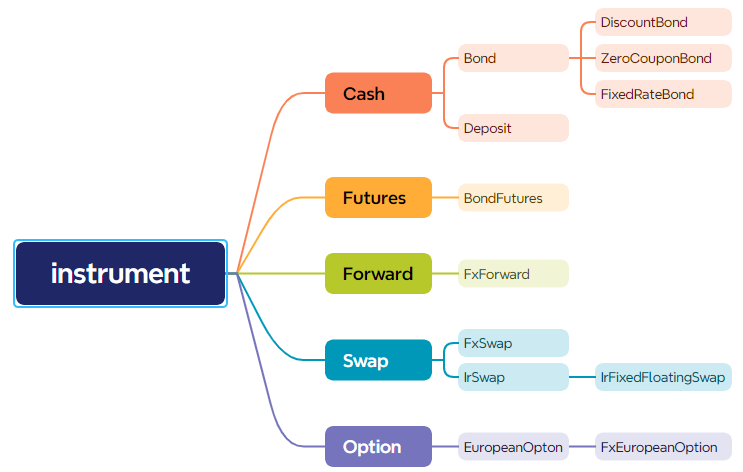

目前支持下图分类树中叶节点所示的金融工具类型:

在定价过程中,系统会按照以下优先级确定市场数据:

-

若 instrument 中已显式指定市场数据,则直接使用该数据;

-

若未指定,则系统根据预定义规则自动匹配合适的市场数据。

以下将对不同类型金融工具的匹配规则进行说明。

债券(Bond)

债券定价需要用到折现曲线。用户可以通过 discountCurve 字段指定折现曲线名称,例如:

bond = {

"productType": "Cash",

"assetType": "Bond",

"bondType": "FixedRateBond",

"instrumentId": "1382011.IB",

"start": "2013.01.14",

"maturity": "2028.01.14",

"issuePrice": 100.0,

"coupon": 0.058,

"frequency": "Annual",

"dayCountConvention": "ActualActualISDA",

"currency": "CNY", //可选字段

"subType": "MTN", //可选字段

"creditRating": "AAA", //可选字段

"discountCurve": "CNY_MTN_AAA" //可选字段

}折现曲线选择规则如下:

-

如果 discountCurve 已指定,则优先使用 discountCurve 的值。

-

如果 discountCurve 未指定:

- 指定了 currency,subType 和 creditRating,系统会选择名为 currency + "_" + subType + "_" + creditRating 的折现曲线。

- 指定了 currency,且 subType 为

TREASURY_BOND,CENTRAL_BANK_BILL,CDB_BOND,EIBC_BOND,ADBC_BOND之一,则不需要 creditRating,系统会选择名为 currency + "_" + subType 的折现曲线。 - 指定了 currency,且 subType 不为

TREASURY_BOND,CENTRAL_BANK_BILL,CDB_BOND,EIBC_BOND,ADBC_BOND之一,同时未指定 creditRating,系统会选择名为 currency + "_TREASURY_BOND" 的折现曲线。 - 指定了 currency,且未指定 subType 和 creditRating,系统会选择名为 currency + "_TREASURY_BOND" 的折现曲线。

- currency,subType 和 creditRating 均未指定,系统会选择名为 "CNY_TREASURY_BOND" 的折现曲线。

国债期货(BondFutures)

无需指定 discountCurve,函数会使用其标的债券(underlying)的 dicountCurve。

存款(Deposit)

存款定价仅需指定折现曲线 discountCurve:

-

如果 discountCurve 已指定,则使用用户指定的曲线进行定价。

-

如果未指定,则根据币种自动匹配折现曲线,规则如下:

| currency | discountCurve |

|---|---|

| CNY | CNY_FR_007 |

| USD | USD_SOFR |

| EUR | EUR_ESTR |

利率互换(IrFixedFloatingSwap)

利率互换定价需要传入三条曲线:discountCurve、forwardCurve 和 assetPriceCurve。当前版本仅支持以 FR_007 和 SHIBOR_3M 作为浮动参考利率的利率互换。

-

如果用户在 instrument 中指定了相应曲线,则使用用户指定的曲线进行定价。

-

如果未指定,则根据币种和浮动利率基准自动匹配三条默认曲线,如下表所示:

| currency | iborIndex | discountCurve | forwardCurve | assetPriceCurve |

|---|---|---|---|---|

| CNY | FR_007 | CNY_FR_007 | CNY_FR_007 | PRICE_FR_007 |

| CNY | SHIBOR_3M | CNY_FR_007 | CNY_SHIBOR_3M | PRICE_SHIBOR_3M |

其中 assetPriceCurve 填入的是浮动参考利率的历史数据,用于计算定价日起第一笔现金流的浮动利率。

外汇远期(FxForward)/ 外汇掉期(FxSwap)

这两类线性产品定价需要绑定 domesticCurve 和 foreignCurve,并基于 currencyPair 获取相应的 FxSpot。

-

若用户在 instrument 中指定了 domesticCurve 和 foreignCurve,则直接使用用户指定的曲线。

-

若未指定,则系统会根据货币对自动匹配默认曲线,如下表所示:

| currencyPair | domesticCurve | foreignCurve |

|---|---|---|

| USDCNY | CNY_FR_007 | USD_USDCNY_FX |

| EURCNY | CNY_FR_007 | EUR_EURCNY_FX |

| EURUSD | USD_SOFR | EUR_EURUSD_FX |

其中 foreignCurve 是根据外汇掉期交易,并结合利率平价公式推导得到的外币隐含即期曲线。

外汇欧式期权(FxEuropeanOption)

外汇期权定价除需使用 domesticCurve 与 foreignCurve 外,还依赖 FxSpot 和 FxVolatilitySurface。

这两个市场数据均可根据期权的 underlying(货币对) 自动匹配。

-

若用户在 instrument 中明确指定,则优先使用用户提供的 domesticCurve、foreignCurve。

-

若未指定,则系统会根据

currencyPair自动匹配,规则如下:

| currencyPair | fxSpot | domesticCurve | foreignCurve | volSurf |

|---|---|---|---|---|

| USDCNY | USDCNY | CNY_FR_007 | USD_USDCNY_FX | USDCNY |

| EURCNY | EURCNY | CNY_FR_007 | EUR_EURCNY_FX | EURCNY |

| EURUSD | EURUSD | USD_SOFR | EUR_EURUSD_FX | EURUSD |

例子

// instrument

//外汇远期

fxFwd1 = {

"productType": "Forward",

"forwardType": "FxForward",

"expiry": 2025.10.08,

"delivery": 2025.10.10,

"currencyPair": "USDCNY",

"direction": "Buy",

"notionalCurrency": "USD",

"notionalAmount": 1E6,

"strike": 7.2

}

fxFwdUsdCny = parseInstrument(fxFwd1)

fxFwd2 = {

"productType": "Forward",

"forwardType": "FxForward",

"expiry": 2025.10.08,

"delivery": 2025.10.10,

"currencyPair": "EURCNY",

"direction": "Buy",

"notionalCurrency": "EUR",

"notionalAmount": 1E6,

"strike": 8.2

}

fxFwdEurCny = parseInstrument(fxFwd2)

//外汇掉期

fxSwap1 = {

"productType": "Swap",

"swapType": "FxSwap",

"currencyPair": "USDCNY",

"direction": "Buy",

"notionalCurrency": "USD",

"notionalAmount": 1E6,

"nearStrike": 7.2,

"nearExpiry": 2025.12.08,

"nearDelivery": 2025.12.10,

"farStrike": 7.3,

"farExpiry": 2026.06.08,

"farDelivery": 2026.06.10

}

fxSwapUsdCny = parseInstrument(fxSwap1)

fxSwap2 = {

"productType": "Swap",

"swapType": "FxSwap",

"currencyPair": "EURCNY",

"direction": "Buy",

"notionalCurrency": "EUR",

"notionalAmount": 1E6,

"nearStrike": 8.2,

"nearExpiry": 2025.12.08,

"nearDelivery": 2025.12.10,

"farStrike": 8.3,

"farExpiry": 2026.06.08,

"farDelivery": 2026.06.10

}

fxSwapEurCny = parseInstrument(fxSwap2)

//外汇欧式期权

fxOption1 = {

"productType": "Option",

"optionType": "EuropeanOption",

"assetType": "FxEuropeanOption",

"notionalCurrency": "USD",

"notionalAmount": 1E6,

"strike": 7.0,

"maturity": 2025.12.08,

"payoffType": "Call",

"dayCountConvention": "Actual365",

"underlying": "USDCNY"

}

fxOptionUsdCny = parseInstrument(fxOption1)

fxOption2 = {

"productType": "Option",

"optionType": "EuropeanOption",

"assetType": "FxEuropeanOption",

"notionalCurrency": "EUR",

"notionalAmount": 1E6,

"strike": 8.0,

"maturity": 2025.12.08,

"payoffType": "Call",

"dayCountConvention": "Actual365",

"underlying": "EURCNY"

}

fxOptionEurCny= parseInstrument(fxOption2)

//债券

bond1 = {

"productType": "Cash",

"assetType": "Bond",

"bondType": "FixedRateBond",

"instrumentId": "220010.IB",

"start": 2020.12.25,

"maturity": 2031.12.25,

"issuePrice": 100.0,

"coupon": 0.0149,

"frequency": "Annual",

"dayCountConvention": "ActualActualISDA",

"discountCurve": "CNY_TREASURY_BOND"

}

bond = parseInstrument(bond1)

//国债期货

bondFut1 = {

"productType": "Futures",

"futuresType": "BondFutures",

"instrumentId": "T2509",

"nominal": 100.0,

"maturity": "2025.09.12",

"settlement": "2025.09.16",

"underlying": bond1,

"nominalCouponRate": 0.03

}

bondFut = parseInstrument(bondFut1)

//存款

deposit1 = {

"productType": "Cash",

"assetType": "Deposit",

"start": 2025.06.15,

"maturity": 2025.12.15,

"rate": 0.02,

"dayCountConvention": "Actual360",

"notionalCurrency":"CNY",

"notionalAmount": 1E6,

"payReceive": "Receive"

}

deposit = parseInstrument(deposit1)

//利率互换

irs1 = {

"productType": "Swap",

"swapType": "IrSwap",

"irSwapType": "IrFixedFloatingSwap",

"start": 2025.06.16,

"maturity": 2028.06.16,

"frequency": "Quarterly",

"fixedRate": 0.018,

"calendar": "CFET",

"fixedDayCountConvention": "Actual365",

"floatingDayCountConvention": "Actual365",

"payReceive": "Pay",

"iborIndex": "FR_007",

"spread": 0.0001,

"notionalCurrency":"CNY",

"notionalAmount": 1E8

}

irs = parseInstrument(irs1)

//mktData

aod = 2025.08.18

fxSpot1 = {

"mktDataType": "Price",

"priceType": "FxSpotRate",

"spotDate": aod+2 ,

"referenceDate": aod ,

"value": 7.1627,

"unit": "USDCNY"

}

fxSpotUsdCny = parseMktData(fxSpot1)

fxSpot2 = {

"mktDataType": "Price",

"priceType": "FxSpotRate",

"spotDate": aod+2 ,

"referenceDate": aod ,

"value": 8.3768,

"unit": "EURCNY"

}

fxSpotEurCny = parseMktData(fxSpot2)

curve1 = {

"mktDataType": "Curve",

"curveType": "IrYieldCurve",

"curveName": "CNY_FR_007",

"referenceDate": aod,

"currency": "CNY",

"dayCountConvention": "ActualActualISDA",

"compounding": "Continuous",

"interpMethod": "Linear",

"extrapMethod": "Flat",

"dates":[2025.08.21, 2025.08.27, 2025.09.03, 2025.09.10, 2025.09.22, 2025.10.20, 2025.11.20,

2026.02.24,2026.05.20, 2026.08.20, 2027.02.22, 2027.08.20, 2028.08.21],

"values":[1.4759, 1.5331, 1.5697, 1.5239, 1.4996, 1.5144, 1.5209,

1.5539, 1.5461, 1.5316, 1.5376, 1.5435, 1.5699] / 100.0

}

curveCnyFr007 = parseMktData(curve1)

curve2 = {

"mktDataType": "Curve",

"curveType": "IrYieldCurve",

"curveName": "USD_USDCNY_FX",

"referenceDate": aod ,

"currency": "USD",

"dayCountConvention": "ActualActualISDA",

"compounding": "Continuous",

"interpMethod": "Linear",

"extrapMethod": "Flat",

"dates":[2025.08.21, 2025.08.27, 2025.09.03, 2025.09.10, 2025.09.22, 2025.10.20, 2025.11.20,

2026.02.24,2026.05.20, 2026.08.20, 2027.02.22, 2027.08.20, 2028.08.21],

"values":[4.3345, 4.3801, 4.3119, 4.3065, 4.2922, 4.2196, 4.1599,

4.0443, 4.0244, 3.9698, 3.7740, 3.6289, 3.5003] / 100.0

}

curveUsdUsdCnyFx = parseMktData(curve2)

curve3 = {

"mktDataType": "Curve",

"curveType": "IrYieldCurve",

"curveName": "EUR_EURCNY_FX",

"referenceDate": aod,

"currency": "EUR",

"dayCountConvention": "ActualActualISDA",

"compounding": "Continuous",

"interpMethod": "Linear",

"extrapMethod": "Flat",

"dates":[2025.08.21, 2025.08.27, 2025.09.03, 2025.09.10, 2025.09.22, 2025.10.20, 2025.11.20,

2026.02.24,2026.05.20, 2026.08.20, 2027.02.22, 2027.08.20, 2028.08.21],

"values":[1.9165, 1.9672, 1.8576, 1.8709, 1.8867, 1.8749,1.8700,

1.8576, 1.9253, 1.9738, 1.9908, 1.9850, 2.0362] / 100.0

}

curveEurEurCnyFx = parseMktData(curve3)

surf1 = {

"surfaceName": "USDCNY",

"mktDataType": "Surface",

"surfaceType": "FxVolatilitySurface",

"referenceDate": "2025.08.18",

"smileMethod": "Linear",

"termDates": [

"2025.08.21",

"2026.08.20"

],

"volSmiles":[{"strikes": [6.5,7,7.5],"vols": [0.1,0.1,0.1]},{"strikes": [6.5,7,7.5],"vols": [0.1,0.1,0.1]}],

"currencyPair": "USDCNY"

}

surfUsdCny = parseMktData(surf1)

surf2 = {

"surfaceName": "EURCNY",

"mktDataType": "Surface",

"surfaceType": "FxVolatilitySurface",

"referenceDate": "2025.08.18",

"smileMethod": "Linear",

"termDates": [

"2025.08.21",

"2026.08.20"

],

"volSmiles":[{"strikes": [7.5,8.0,8.5],"vols": [0.1,0.1,0.1]},{"strikes": [7.5,8.0,8.5],"vols": [0.1,0.1,0.1]}],

"currencyPair": "EURCNY"

}

surfEurCny = parseMktData(surf2)

bondCurve = {

"mktDataType": "Curve",

"curveType": "IrYieldCurve",

"referenceDate": aod,

"currency": "CNY",

"curveName": "CNY_TREASURY_BOND",

"dayCountConvention": "ActualActualISDA",

"compounding": "Compounded",

"interpMethod": "Linear",

"extrapMethod": "Flat",

"frequency": "Annual",

// 0.083 0.25 0.5 1.0 2.0 3.0 5.0 7.0 10.0 15.0 20.0 30.0 40.0 50.0

"dates":[2025.09.18, 2025.11.18, 2026.02.18, 2026.08.18, 2027.08.18, 2028.08.18, 2030.08.18,

2032.08.18, 2035.08.18, 2040.08.18, 2045.08.18, 2055.08.18,2065.08.18, 2075.08.18],

"values":[1.3000, 1.3700, 1.3898, 1.3865, 1.4299, 1.4471, 1.6401,

1.7654, 1.7966, 1.9930, 2.1834, 2.1397, 2.1987, 2.2225] / 100.0

}

curveCnyTreasuryBond = parseMktData(bondCurve)

fr007HistCurve = {

"mktDataType": "Curve",

"curveType": "AssetPriceCurve",

"curveName": "PRICE_FR_007",

"referenceDate": aod,

"currency": "CNY",

"dates":[2025.05.09, 2025.05.12, 2025.05.13, 2025.05.14, 2025.05.15, 2025.05.16, 2025.05.19, 2025.05.20, 2025.05.21, 2025.05.22,

2025.05.23, 2025.05.26, 2025.05.27, 2025.05.28, 2025.05.29, 2025.05.30, 2025.06.03, 2025.06.04, 2025.06.05, 2025.06.06,

2025.06.09, 2025.06.10, 2025.06.11, 2025.06.12, 2025.06.13, 2025.06.16, 2025.06.17, 2025.06.18, 2025.06.19, 2025.06.20,

2025.06.23, 2025.06.24, 2025.06.25, 2025.06.26, 2025.06.27, 2025.06.30, 2025.07.01, 2025.07.02, 2025.07.03, 2025.07.04,

2025.07.07, 2025.07.08, 2025.07.09, 2025.07.10, 2025.07.11, 2025.07.14, 2025.07.15, 2025.07.16, 2025.07.17, 2025.07.18,

2025.07.21, 2025.07.22, 2025.07.23, 2025.07.24, 2025.07.25, 2025.07.28, 2025.07.29, 2025.07.30, 2025.07.31, 2025.08.01,

2025.08.04, 2025.08.05, 2025.08.06, 2025.08.07, 2025.08.08, 2025.08.11, 2025.08.12, 2025.08.13, 2025.08.14, 2025.08.15

],

"values":[1.6000, 1.5600, 1.5300, 1.5500, 1.5500, 1.6300, 1.6500, 1.6000, 1.5900, 1.5800,

1.6300, 1.7000, 1.7000, 1.7000, 1.7500, 1.7500, 1.5900, 1.5800, 1.5700, 1.5600,

1.5500, 1.5500, 1.5600, 1.5900, 1.5900, 1.5700, 1.5500, 1.5600, 1.5679, 1.6000,

1.5700, 1.8500, 1.8300, 1.8400, 1.8500, 1.9500, 1.6036, 1.5800, 1.5200, 1.5000,

1.5000, 1.5100, 1.5100, 1.5300, 1.5200, 1.5500, 1.6000, 1.5400, 1.5400, 1.5000,

1.5000, 1.4800, 1.5000, 1.6000, 1.7500, 1.6400, 1.6200, 1.6300, 1.6000, 1.5000,

1.4800, 1.4700, 1.4800, 1.4900, 1.4600, 1.4600, 1.4600, 1.4800, 1.4800, 1.4900

]\100

}

priceCurveFr007 = parseMktData(fr007HistCurve)

instrument = [fxFwdUsdCny, fxFwdEurCny, fxSwapUsdCny, fxSwapEurCny,

fxOptionUsdCny, fxOptionEurCny, bond, bondFut, deposit, irs]

mktData= [fxSpotUsdCny, fxSpotEurCny, curveCnyFr007,

curveUsdUsdCnyFx, curveEurEurCnyFx, surfUsdCny,

surfEurCny, curveCnyTreasuryBond, priceCurveFr007]

pricingDate = aod

amount = [1, 2, 3, 4, 5, 6, -7, -8, 9, 10]

// case1: mktData is a vector

results1 = portfolioPricer(instrument, amount, pricingDate, mktData)

print(results1)

// case2: mktData is a dict

spots = dict(string, MKTDATA)

spots["USDCNY"] = fxSpotUsdCny

spots["EURCNY"] = fxSpotEurCny

curves = dict(string, MKTDATA)

curves["CNY_FR_007"] = curveCnyFr007

curves["USD_USDCNY_FX"] = curveUsdUsdCnyFx

curves["EUR_EURCNY_FX"] = curveEurEurCnyFx

curves["CNY_TREASURY_BOND"] = curveCnyTreasuryBond

curves["PRICE_FR_007"] = priceCurveFr007

surfs = dict(string, MKTDATA)

surfs["USDCNY"] = surfUsdCny

surfs["EURCNY"] = surfEurCny

dSpots = dict(DATE, ANY)

dSpots[aod] = spots

dCurves = dict(DATE, ANY)

dCurves[aod] = curves

dSurfs = dict(DATE, ANY)

dSurfs[aod] = surfs

mktData2 = dict(STRING, ANY)

mktData2 = {"Price": dSpots,

"Curve": dCurves,

"Surface": dSurfs}

results2 = portfolioPricer(instrument, amount, pricingDate, mktData2)

print(results2)使用市场数据引擎进行定价:

tbdata = table(1:0, `eventTime`type`subType`name`term`price, [NANOTIMESTAMP, STRING, STRING, STRING, STRING, DOUBLE])

insert into tbdata values(now(), "Bond", string(), "0001", "1d", 3.2415)

insert into tbdata values(now(), "Bond", string(), "0002", "1d", 2.1584)

bond1 = {

"productType": "Cash",

"assetType": "Bond",

"bondType": "FixedRateBond",

"nominal": 100,

"instrumentId": "0001",

"start": 2022.05.15,

"maturity": 2032.05.15,

"dayCountConvention": "ActualActualISDA",

"cashflow":[],

"coupon": 0.0276,

"issuePrice": 100.0,

"frequency": "Semiannual"

}

bond2 = {

"productType": "Cash",

"assetType": "Bond",

"bondType": "FixedRateBond",

"nominal": 100,

"instrumentId": "0002",

"start": 2023.05.15,

"maturity": 2033.05.15,

"dayCountConvention": "ActualActualISDA",

"cashflow":[],

"coupon": 0.0276,

"issuePrice": 100.0,

"frequency": "Semiannual"

}

bondcurveConfig = {

"name":"CNY_TREASURY_BOND",

"type": "BondYieldCurve",

"bonds":[parseInstrument(bond1), parseInstrument(bond2)],

"currency": "CNY",

"dayCountConvention": "ActualActualISDA",

"compounding": "Compounded",

"frequency": "Semiannual",

"interpMethod": "Linear",

"extrapMethod": "Flat",

"method": "Bootstrap"

}

engine1 = createMktDataEngine("engine1", 2022.06.10, bondcurveConfig)

engine1.append!(tbdata)

sleep(1000)

ins = parseInstrument(bond1)

results3 = portfolioPricer([ins], [1], 2022.06.10, engine1)

print(results3)